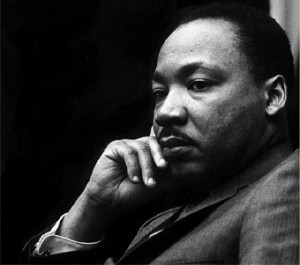

Exactly 49 years after the defining address of Martin Luther King, I Have a Dream, that movingly called for racial equality and freedom from discrimination for fellow African-Americans in the United States, and with the civil rights movements taking giant steps towards the achievements of these ideals, one wonders why the average African-American today still lives within the poverty threshold.

Exactly 49 years after the defining address of Martin Luther King, I Have a Dream, that movingly called for racial equality and freedom from discrimination for fellow African-Americans in the United States, and with the civil rights movements taking giant steps towards the achievements of these ideals, one wonders why the average African-American today still lives within the poverty threshold.

Generations then and now cannot deny that positive changes have been realized for African-Americans, particularly where the end to racial discrimination is concerned. The very fact of this championing of racial equality is found right in the heart of America’s political leadership, in the White House where the first African-American President, Barack Obama, runs the United States. Still, despite this major achievement, the average black individual can still relate to the ideals of I Have a Dream.

Major studies show that African-American families, along with their Hispanic counterparts in the US, still occupy the bottom rung of the economy. According to the U.S. Census and the 2010 report on Income, Poverty, and Health Insurance Coverage in the United States, about 15.1 % of all Americans live below the poverty line, while the percentage of African-Americans living below this threshold is placed at 27.4% or 10.7 million, up by 1.6%. This translates to an annual $11,139 median income in 2010.

The 2011 Consumer Financial Literacy Survey Final Report released in March 2011 by the National Foundation for Credit Counselling shows that compared to the general American racial groups and with the exception of their Hispanic counterparts, majority of African-Americans are prone to assorted financial worries, with no savings at all. And with no savings, there is no means to access healthcare, even typical expenses that hounds an average African-American every day, from adequate food sources to monthly mortgage payments.

Other findings, such as higher incidence of black individuals with limited sense of expenditures and lack of skills and knowledge in budgeting, all point to one thing – inadequate education or total lack of it.

The report reveals that less educated African-American adults are also more likely than other American racial groups to be unaware of even their basic rights to access important personal finance data and documents. These include lack of awareness that they can order a personal credit report, how to go about it, and that it is free. The ability to understand the content and use it to their advantage is another

question. So why is poverty still very much a part and parcel of the average African-American life today?

The landmark book by sociologist Thomas M. Shapiro, The Hidden Cost of Being African American: How Wealth Perpetuates Inequality attempted to provide some answers. Shapiro stated that racial prejudice in America has steadily declined in the past three decades, with many black families experiencing rise in employment status and increase in their annual incomes. However, there are fundamental factors ingrained in the culture of racial inequality that prevents genuine freedom from discrimination.

These factors include a pervading financial culture that negates the average African-American’s success earned in school or in the workplace. One such factor is the lack of family assets among black families, especially those with elderly parents and great grandparents and ancestors who lacked substantial knowledge on property management or asset accumulation due to the restrictions prevalent in their milieu. The present African-American individual, then, loses it out in the areas of credit ratings as far as savings, assets and financial instruments are concerned and collateral availability for important loans.

These give them high risk associations. Attempting to build personal wealth and family stability for a reversal of fate and fortune for the younger generations is hindered by these present situations. Indeed, this racial inequality perpetuates the cycle of poverty for most African-American families.

This situation poses a challenge to the “enlightened” Americans of today, of all racial groups. The remnants of the racial discrimination of the past should be cut and discarded for good, beginning with greater and more relevant education coverage programs that include even elderly African-Americans, granting reprieve to deserving African-American adults in financial record considerations, and sustaining social support programs for the present generation of black youths and children that ensure their strong participation in economic, political and social undertakings in the future, with focus on education and equal opportunity for all.

Whether in policies, programs, advocacy, and actual practice and implementation of these instruments of change, time is crucial so that a significant reversal in the state of African-American living can be immediately realized.

Leave a comment!