While technical analysis often brings to mind the world of investment with its financial charts and graphs, in fact, it offers potential in many different areas of the business world with the insights it points to. Utilizing this potential in business and employee performance can be an important step in creating the maximum efficient working environment for the business. Software-as-a-Service (SaaS) businesses are particularly well suited to exemplify this, where cloud software that facilitates the storage of data is developed and maintained.

Before moving on to the merging of SaaS solutions and financial analysis, it is important to define what SaaS solutions are in the context of the modern workplace. SaaS, or Software as a Service, refers to cloud-based software solutions that can be accessed over the internet. These solutions offer businesses a wide range of applications and tools to support various aspects of their operations, from project management to customer relationship management.

Financial analysis, on the other hand, entails the evaluation and interpretation of financial data to gain insight into a business’s performance and make informed decisions. It involves analyzing financial statements, performing ratio analysis, and performing forecasts and projections.

Defining SaaS Solutions in the Modern Workplace

In today’s fast-paced, digitally-driven world, SaaS solutions have become increasingly popular among businesses of all sizes and industries. These solutions eliminate the need for on-premises software installations and give businesses the flexibility to access and use software applications over the internet from anywhere, anytime. This accessibility enables employees to work more efficiently and collaboratively, eliminating geographical barriers and enabling remote working.

What’s more, SaaS solutions offer businesses scalability and cost-effectiveness. With traditional software installations, businesses often face challenges when it comes to scaling their operations. They need to invest in additional hardware and software licenses, which can be both time-consuming and expensive. But with SaaS solutions, businesses can easily scale their operations up or down according to their needs without the hassle of procuring and managing additional resources.

The Role of Financial Analytics in Business Operations

Financial analysis plays a crucial role in the day-to-day operations of businesses. It helps identify strengths and weaknesses, assess profitability and evaluate the financial health of a company. By analyzing financial data, businesses can uncover trends, identify risks and make data-driven decisions to drive growth and success.

In addition, financial analysis allows businesses to benchmark their performance against industry standards and competitors. In this way, businesses can identify areas where they are successful and where they need to improve. By understanding how their financial performance compares to other businesses in the market, businesses can gain a competitive advantage and make strategic decisions to stay ahead.

The Importance of Combining SaaS and Financial Analysis

Combining SaaS solutions and financial analytics provides numerous benefits for both businesses and employees. Let’s explore two key areas where the integration of these tools can have a significant impact.

Improving Employee Productivity and Efficiency

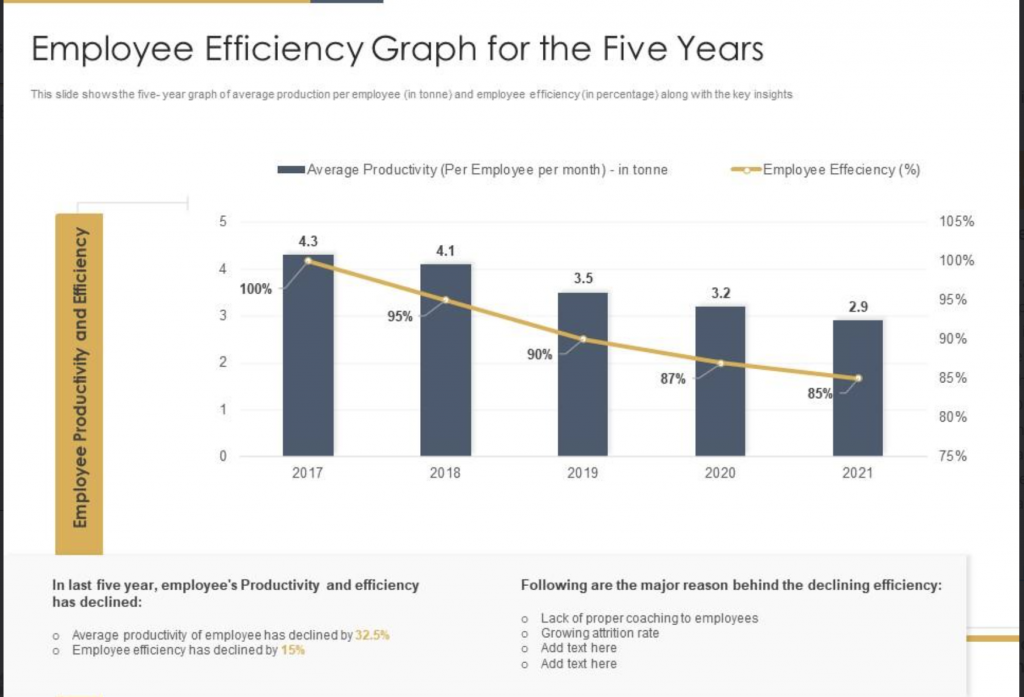

By seamlessly integrating SaaS solutions and financial analytics tools, businesses can give employees instant access to the information they need to make informed decisions. With real-time financial data at their fingertips, employees can analyze performance metrics, track expenses, and evaluate the financial results of various initiatives. This not only saves time but also increases productivity, as employees can focus on value-added tasks instead of manual data entry or searching for information in different systems. Here you can see an example of a graph for employee efficiency over 5 years;

For instance, consider a sales team using a SaaS-based CRM (Customer Relationship Management) system integrated with financial analytics tools. They can track sales performance in real-time, analyze revenue trends, and make data-driven decisions to optimize their sales strategies. This integration streamlines the process, allowing sales reps to focus on closing deals rather than spending time gathering and analyzing data manually.

Streamlining Business Processes and Operations

Integrating SaaS solutions and financial analytics not only increases employee productivity but also streamlines business processes and operations. By automating tasks such as data entry, report generation, and financial forecasting, businesses can eliminate manual errors, reduce the risk of data duplication, and free up valuable resources. This automation allows employees to focus on strategic initiatives and value-added activities that directly contribute to the growth and success of the organization.

For example, consider a manufacturing company using a SaaS-based ERP (Enterprise Resource Planning) system integrated with financial analytics tools. They can automate inventory management, track production costs, and generate real-time financial reports. This integration streamlines operations, reduces administrative overhead, and improves overall efficiency.

Overcoming Employee Challenges with Integrated Solutions

The integration of SaaS solutions and financial analytics goes beyond increasing productivity and streamlining operations. It also addresses common employee challenges, making their work lives easier and more fulfilling.

Improving Communication and Collaboration

Effective communication and collaboration are essential for every successful organization. By combining SaaS solutions with financial analytics tools, businesses can foster seamless communication and collaboration between employees. For example, a cloud-based project management tool can integrate with financial analytics software to enable project teams to track project expenses and budget in real time. This transparency encourages collaboration, enables better decision-making, and ensures everyone is on the same page.

Streamlining Decision Making and Problem Solving

Financial analysis provides valuable insights that can drive informed decision-making and problem-solving. By integrating financial analysis tools into SaaS solutions, businesses equip employees with the tools they need to evaluate the financial impact of different options, assess risks, and identify opportunities for improvement. This data-driven approach to decision-making empowers employees and helps them make better, more strategic choices.

SaaS and the Future of Financial Analytics Integration

As technology continues to evolve, the integration of SaaS solutions and financial analytics will become stronger and more effective. Let’s take a brief look at the predicted trends and developments in this area:

Forecasted Trends and Developments

Advanced Analytics: The combination of AI and financial analysis will enable businesses to leverage advanced analytics for more accurate forecasts, predictive modeling, and risk analysis.

Real-Time Reporting: Real-time financial reporting will become the norm with cloud-based solutions providing instant access to financial data and reports. This will enable businesses to make agile decisions based on the latest information.

Data Integration: SaaS solutions will continue to enhance data integration capabilities, allowing businesses to seamlessly combine data from various sources and gain a holistic view of their financial performance.

Preparing for the Future: Steps for Businesses

As the future of SaaS solutions and financial analytics integration unfolds, businesses should take proactive steps to stay ahead of the curve and capitalize on these developments:

- Stay abreast of technological developments and trends in SaaS and financial analytics.

- Improve chart analysis. Patterns revealed by data can provide highly reliable messages about the future.

- Invest in powerful SaaS solutions that seamlessly integrate with financial analytics tools to streamline operations and improve decision-making.

- Provide ongoing training and support to employees to ensure they can effectively leverage integrated solutions.

- Maintain a data-driven culture and encourage employees to embrace data analysis as a core component of their decision-making.

As a result, the integration of Software as a Service solutions and financial analytics represents a powerful synergy that can drive efficiency, productivity and innovation in modern businesses. By leveraging the accessibility and scalability of SaaS applications and the insights gained from financial analytics, organizations can gain a competitive advantage in today’s dynamic marketplace.

From increased employee productivity and streamlined operations to better communication and decision making, the benefits of combining SaaS and financial analytics are multifaceted. As technology continues to evolve, businesses must be proactive in adopting these integrated solutions to stay ahead and capitalize on emerging trends.

By investing in powerful SaaS platforms that seamlessly integrate with financial analytics tools and nurturing a data-driven culture within their organizations, businesses can empower their employees to make informed decisions and drive sustainable growth.

In an ever-evolving business world, the integration of SaaS solutions and financial analytics holds the key to unlocking new possibilities and driving success in the digital age. Therefore, businesses that embrace this convergence are poised to thrive in the coming years.

Leave a comment!