The pros and cons of Airbase are anchored on its comprehensive tools that effectively streamline spend management processes. From guided procurement to expense tracking and corporate card management, Airbase provides timely insights and control over company spending. However, it may not be the best fit for smaller businesses as the platform’s features and tools are tailored to enterprises.

Spend management can be a big headache for businesses. As a company scales, it can be difficult to manage expenses efficiently. This can result in a lot of wasted time and resources.

Moreover, spending data is traditionally siloed into different teams, departments, or business units, limiting the finance team’s visibility and ability to spot cost-saving opportunities.

A full-featured procurement and spend management software helps address these challenges by providing financial departments with real-time data on spending patterns, simplifying the identification and prioritization of useful expenses. It also integrates with other enterprise software to get rid of siloes, streamline spend management, and improve decision-making for managers.

In this article, we’ll review the pros and cons of Airbase, a leading spend management platform, and see how the software helps solve many of the issues companies face when managing expenses. You’ll learn about Airbase’s unique features and whether it fits your company’s spend management requirements.

What are the pros and cons of Airbase?

One study found that AP teams spend a substantial amount of time (42% of one full-time AP employee’s time) managing non-payroll expenses, indicating potential resource misuse. Also, 37% of SaaS firms with 100-500 employees are interested in automating non-payroll spending.

Source: PYMNTS, 2022

Without a clear view of where company funds go, decision-makers cannot make informed choices, optimize spending, or effectively steer the organization toward financial health. Poor spend management can significantly impact a company’s profits, especially when external spending makes up a substantial part of total costs, ranging from 40% to 80%. Without proper spend visibility, businesses risk losing a significant portion of their budget to unmonitored expenses.

Spend visibility is one of the key features of Airbase that can provide transparency and efficiency in managing non-payroll expenses. We’ll look at this feature closely and other ways the platform addresses the challenges of finance teams.

What is Airbase?

Airbase is a unified and feature-rich spend management platform that enhances financial control and transparency for organizations, thus making it a valuable tool for CEOs, CFOs, and finance teams. It has four modules—Guided Procurement, Accounts Payable Automation, Expense Management, and Corporate Cards. You can implement Airbase in whole or in part and just choose the more urgent and relevant module for your organization.

Airbase seamlessly combines features for implementing corporate cards, managing bill payments, and processing employee reimbursements. Users can leverage virtual and physical corporate cards, complete with approval workflows, spend controls, and robust security measures.

One standout feature is real-time transaction visibility, enabled by OCR technology, which allows users to upload receipts immediately after purchases. This eliminates the hassle of tracking down receipts and simplifies expense management.

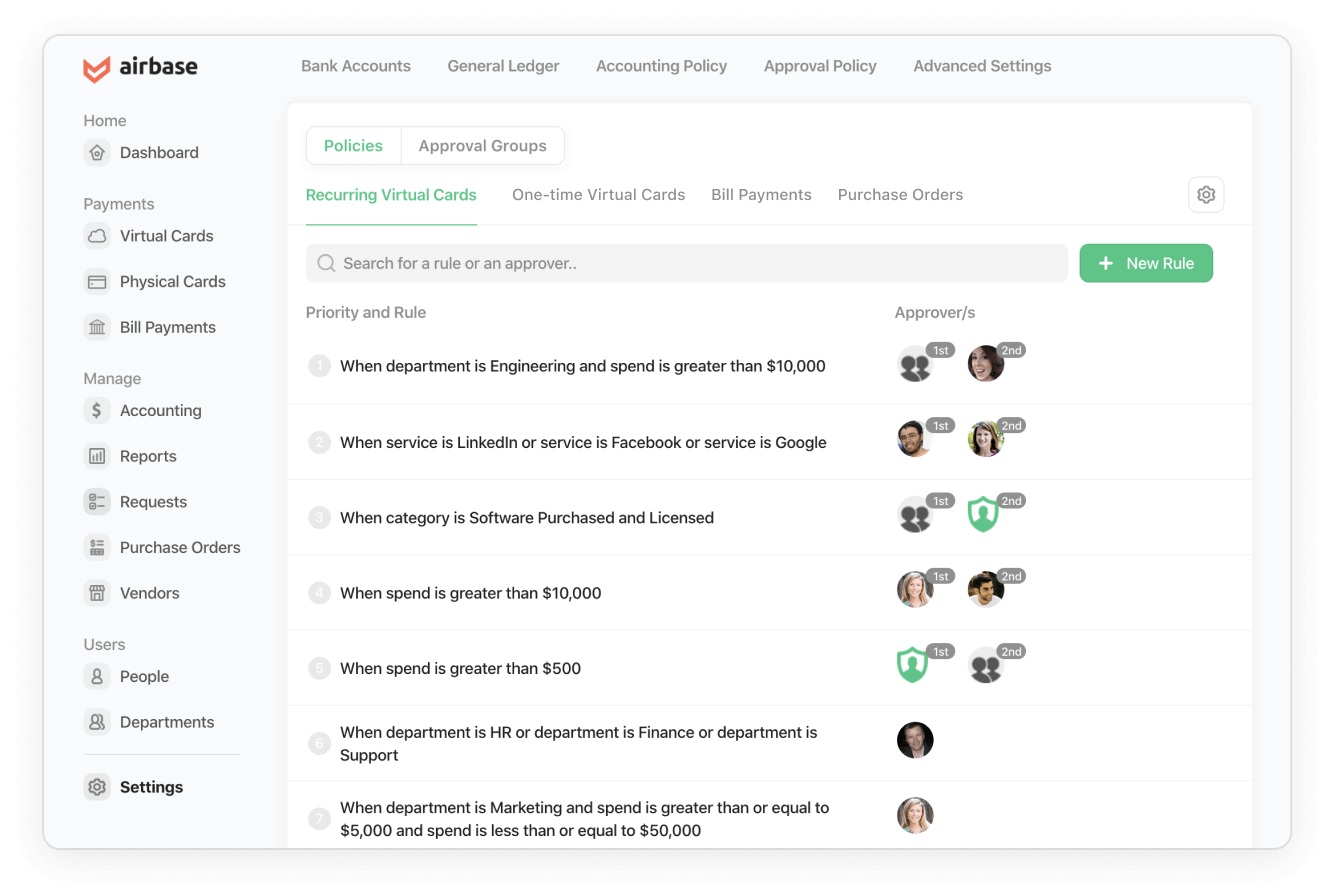

Airbase also excels in streamlining expense approvals with its advanced approval features. Managers and administrators can create customized approval workflows, apply rule-based criteria, and collaborate effortlessly through communication channels like Slack and email.

Moreover, the platform ensures compliance with spending and risk controls through Guided Procurement, helping employees gather necessary documentation before making purchases.

Detailed Airbase Review

The following are key features of Airbase:

- Visibility For All Non-Payroll Spend

- Advanced Approvals

- Automatic Audit Trail

- Real-time Reporting

- Multi-Subsidiary & Multi-Currency

- Visibility

- Security & Fraud Detection

- Bill Payments

- Purchase Orders

- Vendor Portal

- Reimbursements

- Spend Controls

- Virtual Cards

Airbase Pros and Cons

Visibility For All Non-Payroll Spend

Airbase’s spend visibility features provide a 360-degree view of spending for all stakeholders at any given time. This transparency allows for better control and efficiency in managing non-payroll spending.

Real-time reporting and audit trail

For example, Airbase is capable of real-time reporting and audit trail so that all non-payroll spending can be captured in real-time in one system. Transactions also automatically sync to your company’s general ledger to keep books up-to-date.

Leadership, finance teams, and employees don’t need to review expenses until after the month-end close. They can easily trace and verify every transaction, which enhances accountability and reduces financial discrepancies. With a clear view of actual spending on any day of the month, stakeholders can make better decisions about budgets and finances.

Filters, categories, and tags

Moreover, accounting and finance teams can easily filter transactions with missing receipts or documentation. You save a lot of time since you don’t have to search through forms, email threads, or company messaging apps to find expense reports.

Categories and tags also provide spend visibility by allowing budget owners to review and confirm the accuracy of an expense type/classification before the purchase is made. Using this proactive approach reduces errors, helps teams avoid delays in month-end closings, and improves workflow management. Airbase’s fraud detection alerts improve security by notifying cardholders of potential fraud and protecting the company’s finances.

Approval workflows

Airbase increases transparency through approval workflows that can be integrated seamlessly into messaging tools like Slack and email. The platform routes requests for purchase approvals to the right approvers based on your company’s policies, so employees can still receive the funds they need even if they are working remotely.

These are just some of the features that make Airbase a top platform for spending visibility. While feature-rich, a downside could be the learning curve involved when you first use the platform. It’s essential to consider your team’s adaptability and training needs.

Advance expense approvals route approval requests to the right approvers.

Streamline and Automate Accounts Payable

Central to any discussion on the pros and cons of Airbase are its AP automation features, which simplify and optimize the entire accounts payable process. It eliminates manual and time-consuming tasks, reduces errors, improves efficiency, and provides greater visibility and control over financial operations.

Some of the manual tasks you can automate include capturing invoices electronically, verifying them against purchase orders and rules, customizing approval workflows, executing electronic payments, updating the general ledger, and providing comprehensive reporting.

AP Automation can also find and flag duplicate payments. It uses smart algorithms to compare payment data with existing records, considering factors like vendor names, invoice numbers, amounts, and dates. When a potential duplicate is spotted, it alerts the AP team for review. This helps prevent accidental or fraudulent duplicate payments, improving accuracy, compliance, and cost savings for businesses.

When your AP processes are automated, you also improve your supplier relationships. It speeds up invoice processing, leading to quicker payments, which benefits suppliers by reducing payment cycles and improving cash flow predictability. The platform also offers visibility into invoice status, allowing suppliers to monitor invoices. These features contribute to increased trust, better communication, and enhanced satisfaction between businesses and their suppliers.

A thing to note is that Airbase primarily focuses on spend management and may lack some advanced accounting features that larger or more specialized accounting software may offer. If your organization has complex accounting requirements, you may need to complement Airbase with additional accounts payable software.

Ensure Compliant and Fully Documented Spending

With a simple interface available on both desktop and mobile apps, employees can easily submit their expense reports to Airbase, which helps in timely submissions.

Airbase simplifies receipt management by allowing users to easily capture and submit receipt images via mobile or save them for later. Its OCR technology automatically extracts expense details, making submissions easier.

Moreover, the platform ensures policy compliance by automating approvals, flagging out-of-policy expenses, and offering customization options like mandatory fields and budget limits.

If your organization has global partners or operations, Airbase can streamline international reimbursements. It supports both U.S. and international subsidiaries across various currencies.

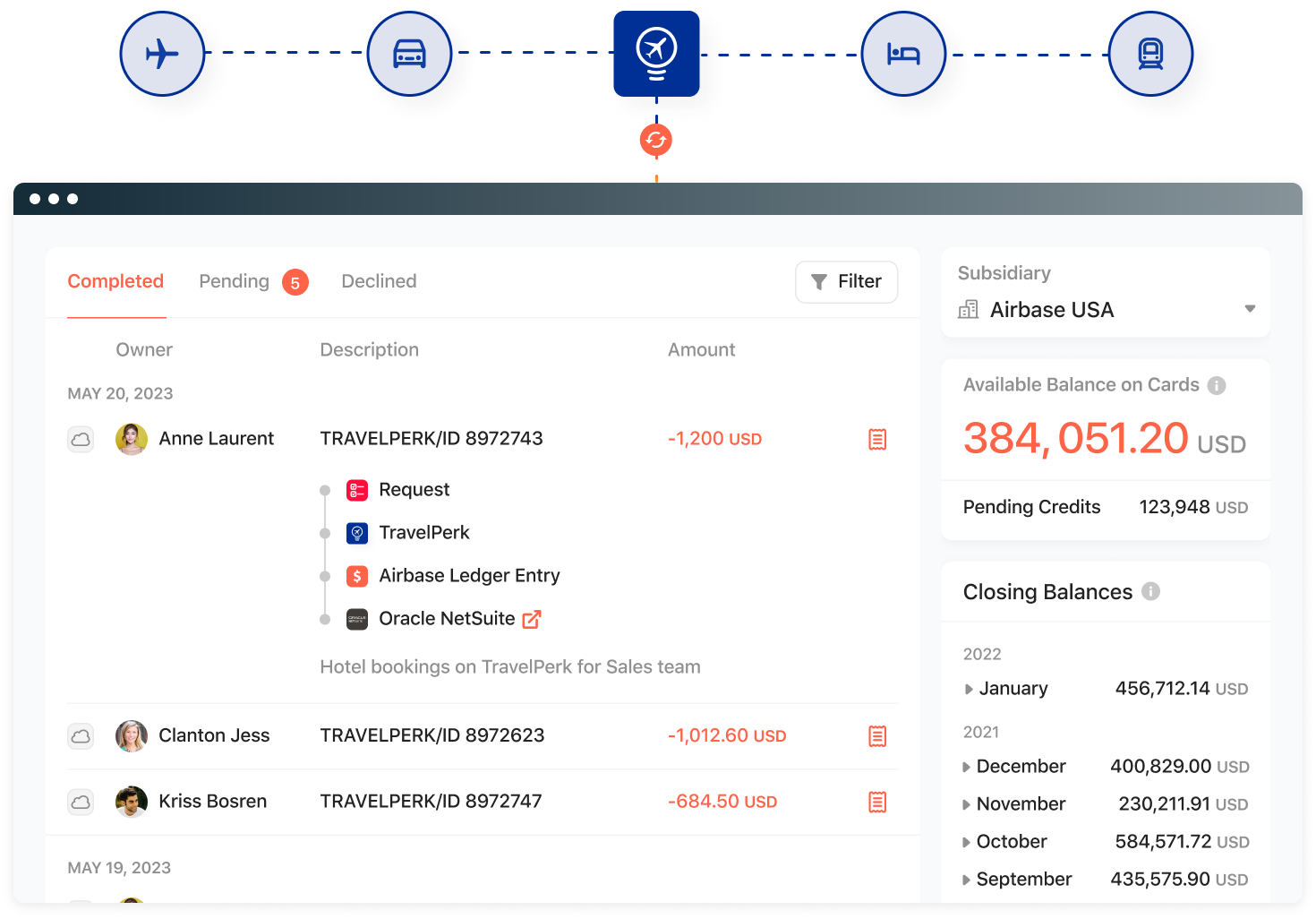

Meanwhile, if you’re worried about managing travel expenses, Airbase can help. Its integration with travel booking systems grants better control over travel expenses and ensures that travel bookings are aligned with company policies.

To improve user experience, Airbase automates reimbursements, directly transferring approved funds to employees’ bank accounts, and reducing manual processes for out-of-pocket expenses.

With many advanced features, Airbase is tailored for mid-size to large companies. Designed for businesses with 100 to 5,000 employees, it may not be ideal for smaller businesses. Smaller companies may find the platform to be overly complex for their needs.

Airbase’s travel booking integration: Provides control and visibility over travel spending.

Improve Spend Control

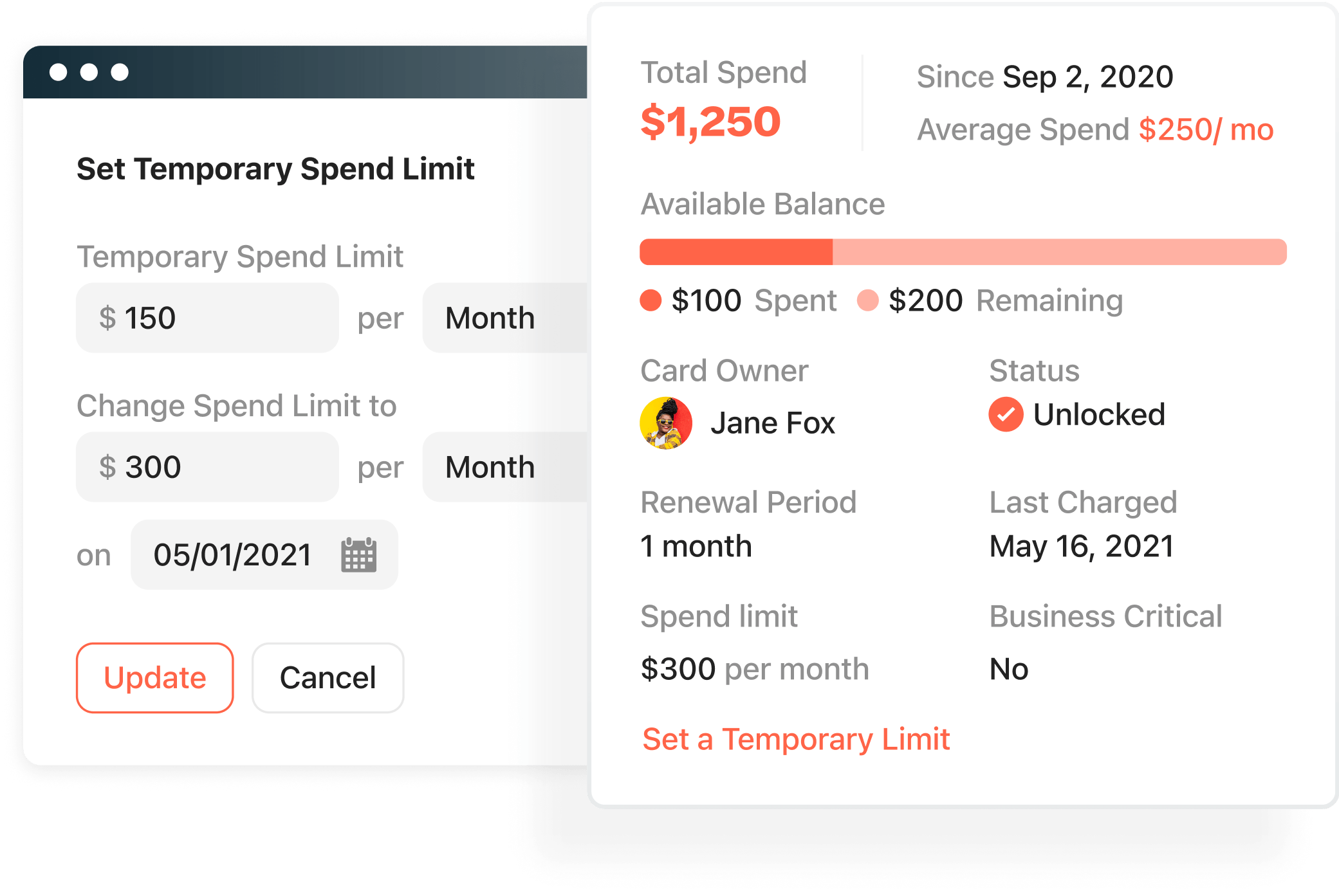

Airbase’s Corporate Cards module offers comprehensive features to improve spend control, enhance security, and simplify expense management within your organization. When you use Corporate Cards powered by Airbase, you benefit from a streamlined and controlled spending process, where all transaction details seamlessly sync with your general ledger.

You can set spending restrictions on Corporate Cards and make adjustments as circumstances change. There are two options available: virtual and physical cards. Virtual cards can be used with pre-approval workflows, while physical cards are suitable for point-of-sale purchases, giving you greater budget control.

Additionally, you can limit card expenditures to particular categories, examine transactions that have been flagged or blocked, and grant exceptions based on previous behaviors. There’s also unlimited cash back on all spending categories without the complexity of rewards gimmicks or promotional periods, and you can access your cash back every month.

Security and Integration

For accurate general ledger synchronization, Airbase offers an auto-categorization feature for both physical cards and invoices. It also integrates seamlessly with popular accounting software such as Oracle NetSuite, Sage Intacct, QuickBooks Online, QuickBooks Desktop, and Xero.

Security is prioritized with automatic fraud detection that alerts cardholders to suspicious transactions. Airbase offers contactless payments with its physical cards that can be easily added to digital wallets like Apple Pay and Google Pay.

Moreover, the platform allows you to customize card types to fit your company’s specific needs. For instance, you can create a “Per Diem” card with daily spending limits for meals, set to expire upon the employee’s return.

Manage Corporate Card budgets: Set limits to card spending and adjust when needed.

What are common use cases for Airbase?

Airbase is a versatile spend management platform that caters to various organizational needs. Here are some common use cases that highlight its effectiveness across different scenarios:

- Expense Management: Companies use Airbase to streamline expense reporting and approval process. Employees can easily submit expenses through the platform, and managers can review and approve them quickly, ensuring compliance and reducing administrative workload.

- Budgeting and Forecasting: Airbase assists finance teams in creating and managing budgets. The platform allows users to set budgets for departments or projects, monitor spending in real-time, and forecast future expenses based on historical data, enhancing financial planning.

- Vendor Management: Airbase makes managing vendor relationships easier. Organizations can track vendor contracts, manage payments, and analyze vendor performance all in one place. This centralized approach helps maintain healthy vendor relationships and optimizes procurement processes.

- Automating Accounts Payable: Airbase automates various accounts payable processes, such as invoice approvals and payment scheduling. This automation minimizes manual errors, accelerates payment cycles, and improves cash flow management, making financial operations more efficient.

- Reporting and Analytics: The platform provides robust reporting features that allow finance teams to generate insights on spending patterns, departmental budgets, and overall financial health. These analytics empower decision-makers with data-driven insights to guide strategic planning.

Is Airbase a good fit for your organization?

Wrapping up our guide on the pros and cons of Airbase, the software is a robust spend management platform with its share of benefits and limitations. Among its strengths is its ability to offer extensive spend visibility, real-time reporting, and time-saving tools for finance and accounting teams. The platform simplifies expense approvals, automates accounts payable processes, and facilitates efficient company spending management.

However, there are some downsides to consider. Airbase may pose a learning curve for users during implementation, making it less suitable for less adaptable organizations. It may also lack a few advanced accounting features, necessitating supplementary software for complex accounting requirements. You also need to contact the vendor to request a customized pricing quote based on the size of your company.

Just like with any of the best procurement software tools, Airbase allows you to choose the module you need and benefit from its procurement and spend management features. If the platform suits your needs, you can easily implement the rest of the modules. Consolidating all your company spend on one platform has clear benefits, such as saving money using just one system and avoiding the hassle of dealing with multiple solutions and outputs.

Leave a comment!