A portfolio tracking software, also known as a portfolio management system, is an application that helps investors monitor and manage their investment portfolios.

It provides users with real-time updates on the performance of their investments, including stocks, mutual funds, bonds, and other assets. This software also allows investors to track their overall investment strategy, review historical data, and make informed decisions based on market trends.

Portfolio tracking software offers numerous benefits to both individual and institutional investors. This article will discuss ten key benefits of using it.

Who Uses Portfolio Tracking Software?

Portfolio tracking software is used by various groups of investors, including individual traders, financial advisors, institutional investors like banks and pension funds, and fund managers.

Whether you’re an experienced investor or just starting, this tool can help you achieve your investment goals.

It’s beneficial for investors with diversified portfolios, as well as those investing in specific financial instruments.

What Are The Benefits of Portfolio Tracking Software?

So, what are the benefits of portfolio tracking software?

Let’s take a closer look at the top ten advantages that this tool offers.

1. Real-time Portfolio Monitoring

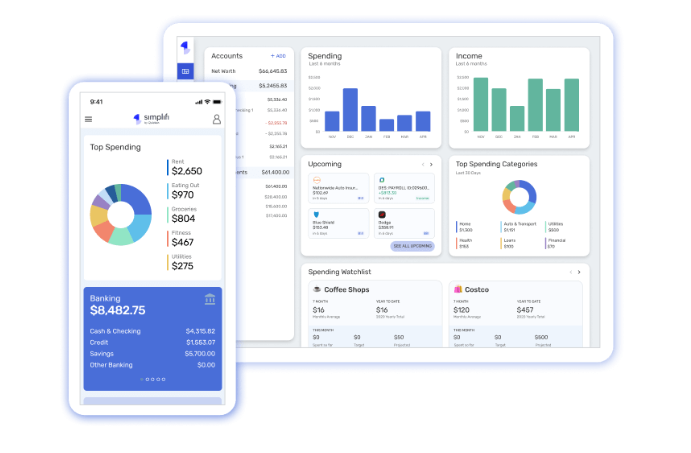

One of the significant advantages of using portfolio tracking software is the ability to monitor investments in real time. This means that investors can access up-to-date information on their portfolio’s performance anytime, anywhere. With this feature, users can quickly identify any potential issues and make necessary adjustments to their investment strategy.

Investors can also use the software’s alerts and notifications to stay informed about market changes, such as stock price fluctuations or news related to their investments. This real-time monitoring allows for more efficient decision-making and can help people stay ahead of market trends.

Plus, with the ability to track multiple portfolios, investors can easily compare different strategies and make adjustments accordingly.

2. Education Resources

Many portfolio-tracking software options provide educational resources to help investors learn more about investing and managing their portfolios. These resources may include articles, tutorials, webinars, or access to financial advisors.

By using these educational resources, investors can improve their understanding of the market and make better investment decisions. This feature is particularly helpful for beginners who are just starting to build their portfolios.

3. Diversification Tools

Diversification is an essential aspect of smart investing and portfolio tracking software can assist investors in achieving this goal. With the ability to track multiple portfolios and assets, people can easily diversify their investments. This means spreading out investments across various asset classes, reducing risk, and potentially increasing returns.

Some portfolio tracking software also provides tools and recommendations for diversification based on an investor’s risk tolerance and financial goals. This way, users can make informed decisions when it comes to building a well-diversified portfolio.

4. Tax Management

Keeping track of taxes can be a daunting task for investors, especially those with multiple investments. However, portfolio tracking software can simplify this process by providing tax management tools. This includes features such as capital gains calculations and tax-loss harvesting suggestions.

The software automatically calculates capital gains or losses, dividend income, and other relevant information needed for tax filing. This feature saves users time and reduces the risk of errors in their tax reporting.

5. Cost-saving

Portfolio tracking software can help investors save money in the long run by providing a comprehensive overview of their investments. With real-time monitoring and historical data analysis, users can spot any underperforming assets and make necessary adjustments to their investment strategy.

Additionally, many portfolio tracking software options offer different pricing plans designed to fit different budgets. This flexibility allows them to choose a plan that best suits their needs and budget without sacrificing critical features.

6. Diversification and Risk Management

Portfolio tracking software allows investors to diversify their portfolios by providing them with a holistic view of their assets. With this software, they can see which investments are performing well and make adjustments to balance out risk.

Additionally, the software offers tools to help investors manage their portfolio’s risk level by setting limits and alerts for specific asset classes. This feature allows for more effective risk management and can help minimize losses in volatile markets.

7. Goal Setting and Tracking

Many portfolio-tracking software options offer goal-setting features, allowing investors to set specific financial goals and track their progress. This feature serves as a helpful reminder for long-term investment strategies and can help keep people focused on their objectives.

With the ability to monitor progress toward financial goals, investors can make necessary adjustments to their portfolio, to present their financial planning or investment strategy and ensure they stay on track. This feature also helps users stay disciplined and avoid making impulsive or emotional decisions.

8. Accessibility

Portfolio tracking software is accessible from various devices, such as computers, smartphones, and tablets. This means that investors can access their portfolio information whenever and wherever they need it. With this level of accessibility, users can stay informed about their investments even when they are on the go.

Plus, with cloud-based options, investors can access their portfolio information from any internet-connected device, making it convenient and efficient to manage investments remotely.

9. Customizable Reports

Portfolio tracking software offers customizable reports that provide a comprehensive overview of an investor’s portfolio performance. These reports include data such as returns on investment, asset allocation, and diversification levels.

With customizable reports, users can easily analyze their portfolio’s performance and make informed decisions. This feature also allows for a more personalized experience and helps investors track the specific metrics that matter to them.

10. Historical Data Analysis

Portfolio tracking software also allows people to analyze historical data, providing valuable insights into past performance. This feature is particularly useful for long-term investors who need to review their investment strategies periodically. By analyzing historical data, it is possible to identify patterns and trends in their portfolio’s performance and make more informed decisions for the future.

Additionally, historical data analysis can help investors track their progress toward their financial goals. By comparing past performance to current investments, it is possible to determine if they are on track or need to adjust their strategy.

What Are the Cons of Portfolio Tracking Software?

While portfolio tracking software offers several benefits, it also has some disadvantages. One of the main drawbacks is that it comes with a cost.

Most portfolio tracking software requires users to pay for a subscription or license fee to access all its features fully. This cost may be an issue for individual investors with limited financial resources.

Another disadvantage is that not all portfolio tracking software offers the same level of features and customization. Some may have limited capabilities, while others may be too complex for beginners.

Some investors also find it challenging to integrate the software with their existing investment management systems or data sources.

Takeaways

Overall, portfolio tracking software offers numerous benefits for investors of all levels.

From real-time monitoring and historical data analysis to tax management and education resources, these tools can help people make more informed decisions, diversify their portfolios, manage risk, track progress toward financial goals, and save time and money in the long run.

With a variety of options available on the market, users can choose the software that best fits their needs and budget to take advantage of these benefits.

So, for smart investing and efficient portfolio management, using portfolio tracking software is highly recommended.

Leave a comment!