A solid accounting foundation is key to running and growing a company. This entails practicing good financial housekeeping and using the right tool now, not tomorrow. This is especially so as the COVID-19 pandemic has brought forth more complex scenarios—like managing remote workers, perhaps, fewer customers, smaller advertising budget, along with the usual headaches in balancing the sheet. As you fiddle with thoughts of growing the business, one of these should be getting the right accounting software that you can start with cheap, but grow with advanced tools.

In this article, we will present the 20 best accounting software for small business as determined by our experts. Their features, benefits, and pricing will be discussed. Many of these solutions are more similar than different, hosting standard features like general ledger management, invoicing, and payment processing. But it is the little things that can be the deal-breaker (e.g., scalability, support, reliability), so pay attention closely.

What are the 20 best accounting software for small businesses in 2026?

Before the COVID-19 pandemic, we witnessed an increase in the adoption of accounting applications. However, at the same time, it was found that only 37% of accountants use cloud-based accounting solutions. This has been deemed as a significant disparity, especially with the rising demands from businesses to be more agile. Cloud accounting solutions provide businesses and accounting professionals the perfect platform to do so. This statistic, however, showed that during this time, many are not so gung-ho about the idea of switching to the cloud.

Then, COVID-19 forced them to switch. When the pandemic hit, a record +13% point increase in IT workload was placed on the cloud. With social distancing protocols and remote work configurations, many firms and professionals started seeing that cloud accounting tools give accountants a technological edge.

Source: Forbes, 2020

They do not only allow users to react to issues and opportunities in real-time but also provide them with a support team that does as well. This is because many cloud accounting software providers are proactive in providing their clients with highly-personalized tools suited for their particular needs.

As businesses look to go beyond traditional software features, many are now adopting AI bookkeeping assistants that automate accounting tasks, reduce manual data entry, and support finance teams in real time.

Purchasing web-based software solutions are not just a one-size-fits-all-you-pay-get-on-your-way deal. Cloud software providers are generally more interested in their client’s success more than their strictly on-premise counterparts. It is because they know that their success also rests on yours. It is definitely great to have them on your team.

20 Top Accounting Software for Small Business

1. NetSuite ERP

NetSuite ERP packs general ledger and other financial tools with eCommerce, sales, and marketing to grow your business. The sales tool includes a contact manager that lets you manage leads, automate communication, track your sales pipeline, generate quotes, and sync calendars with your teams for enhanced collaboration. The eCommerce component integrates order management with order processing and fulfillment. An inventory management tool takes care of your stocks, and a shipping module gives you the flexibility of features that you can add as your need expands.

A powerful, elegant dashboard gives you access to KPIs. It’s all accessible via any mobile device. There’s a file manager that makes it easy to share and work on any task, a powerful reporting tool, and a tool that lets you export or import records as the case may be. The intuitive dashboard lets you see everything at a glance. It’s made easy to use by even non-experts, so you and your staff can worry about your business rather than your software.

What’s unique about NetSuite ERP?

- Made for your business. NetSuite ERP for small businesses is an affordable bundle of powerful solutions that you can easily scale to your needs and implement quickly. It is easy to configure and sports an interface that does away with a complex setup.

- A single tool to handle everything. With a strong financial core, modules for sales, marketing, and commerce with order management, as well as a host of other essential capabilities, your first order of business is not about looking for a third-party application to integrate but everything about real needs by your customers.

- Instantly know if your business is missing something. The application generates all crucial business indicators at your fingertips, so you don’t have to second-guess your next action.

- Modern and fully mobile. If you have an internet connection and a fully capable smartphone or tablet, then NetSuite goes with you wherever you are on the planet.

- Configure once and run. Once you have set up NetSuite ERP, all you have to do is let it run your operations rather than trying to address software issues. Cloud access eliminates the substantial cost of ownership.

Detailed NetSuite ERP Review

2. Paychex

Paychex is another leading online HR and payroll solution that helps small businesses simplify their payroll processing and payroll tax filing processes. Its most affordable subscription package, Paychex Flex Essentials, is specifically designed for businesses with one to 19 employees.

This cloud-based software is equipped with its proprietary Paychex Flex technology that offers a comprehensive suite of tools for managing and streamlining payroll processes from a desktop or the mobile app. Among the capabilities it offers are online payroll processing, tax pay and payroll tax administration, and tax credit services. Paychex provides SMBs with multiple options to send payments to their employees. These payment options include direct deposit, checks, and electronic deposit to prepaid pay cards.

Aside from the essential payroll and tax service features for small business owners, Paychex enables employees to have control over updating their company and personal information via the online employee self-service feature. This gives employees access to their payslips, tax withholding forms, and learning resources for career advancement.

What’s unique about Paychex?

- Proprietary payroll service technology for SMBs. Paychex Flex is Paychex’s unique technology designed as a payroll-only online solution for small and medium-sized businesses.

- Voice-assisted payroll service. Paychex Voice Assist supports hands-free automated payroll processing via the web or mobile app.

- Free mobile application. Paychex provides businesses and employees with free mobile applications to easily access its payroll and HR features, as well as other services while on the go.

- Multiple employee payment options. Aside from the standard direct deposit to the employee’s bank account, Paychex also supports payment via paper checks, check logo service, check signing, and prepaid cards.

- Financial wellness program. This enables businesses to assist their employees in meeting their financial goals with help of learning resources and access to short-term loan programs.

Detailed Paychex Review

3. QuickBooks Online

QuickBooks Online is an accounting solution specifically targeted at small businesses and freelancers as it simplifies the most complex accounting processes. It has become a popular tool among accountants, bookkeepers, small business owners, and finance officers. For up to five users, all the app’s features can be accessed. However, functionalities are limited for packages with an unlimited number of users.

A notable benefit is how it automatically syncs business profiles to a single dashboard, where multiple users can view reports and corporate accounts. It is capable of generating profit and loss and trade sheets, invoices and billing, all of which are accessible via mobile devices. Custom reports and feeds can likewise be created from the dashboard. Popular integrations include Quickbooks Online Payroll and Intuit GoPayment.

The app is being offered in a variety of pricing schemes, starting at $18/month. A free trial is available to those who want to try the software’s features first.

What’s unique about QuickBooks Online?

- Accounts management. The app provides users with access to accounting information and allows for the creation, editing, sharing and duplication of the same with relevant parties.

- Online accessibility. Users can log in to the system wherever there is Internet access without the need for any additional software. The creation of customizable feeds and charts can also be accomplished.

- Security and backups. All accounting information is securely stored in the cloud. These can be accessed and exported to Excel spreadsheets.

- Support and upgrades. All subscription packages come with support from the time of set up. Regular updates and upgrades are also provided.

Detailed QuickBooks Online Review

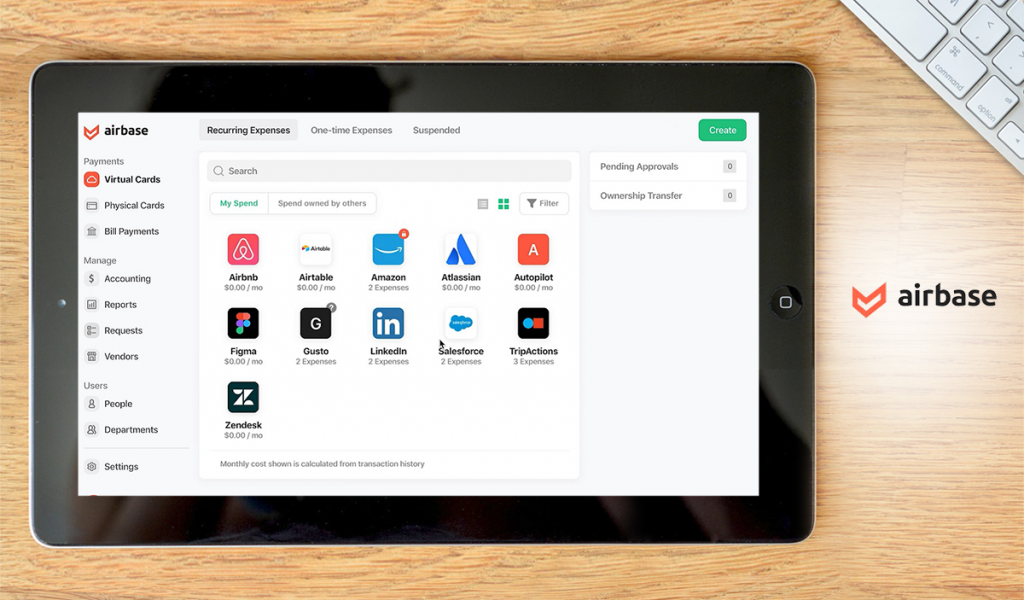

4. Airbase

When it comes to the entire procurement process, no other platform compares to the power and sophistication of Airbase. The primary goal of this spend management software is to considerably streamline the global procurement procedures of businesses operating in the small to large mid-market and enterprise-level sectors.

Users really like that they can see transactions happening in real-time on Airbase. In contrast to other solutions that might need several days to populate transactions, Airbase lets you quickly upload receipts after a purchase. The relevant information is scanned using optical character recognition (OCR) technology powered by artificial intelligence (AI). For the reason that transactions show up instantly on the platform, it may be easier to keep track of costs and lessen the stress of losing transaction data.

This spend management solution determines the best pricing package for users by offering standard, premium, and enterprise packages.

What’s unique about Airbase?

- Custom approval workflows. The adaptable approval solution enables you to effortlessly generate custom rules and dispatch approvals to one or more approvers in any desired order. These regulations may be modified in accordance with the evolving requirements and organizational framework of your business.

- Multi-subsidiary and multi-currency. Airbase simplifies the workflows of users, from permissions through accounting and reporting, for both domestic and overseas operations. To better organize your worldwide expenditures, the system supports payments in multiple currencies.

- Spend controls. Policies can be enforced and compliance can be tracked automatically by switching to a rule-based approach. Approvals are required up front for virtual cards and purchase requests before any spending can occur. They can be implemented on a per-department or per-dollar-amount basis.

Detailed Airbase Review

5. Tipalti

Tipalti is a cloud-based payment automation and management software that is known for helping businesses accurately meet deadlines. The solution helps solve problems that include non-compliance, late payments, administrative overload and complications arising from human error. Time spent on financial management is significantly decreased, solving one of the biggest problems facing accounting teams.

Aside from those mentioned, the software can automate any business’ payment operations around the world, which could range from tasks like onboarding to tax compliance. It is capable of streamlining payment processing in around 190 countries. Using the product, businesses can rest assured that they are compliant with all existing tax and regulatory requirements minus too much human intervention. Customer and vendor payment experiences are likewise improved, along with service quality.

Tipalti is available on a price quote basis. Interested parties can contact the vendor to get a customized quote.

What’s unique about Tipalti?

- Automated payment. The system automates around 50% of all payment processes in 190 countries. It’s a leading solution for payment reconciliation, financial reporting, and AP. It normalizes data over a wide array of payment gateways.

- Payment facilitation. The software makes payment easier than one can imagine. Users can pay across 190 countries, 120 currencies, and 6 payment methods. It has an advanced payment configuration, providing myriad financial controls.

- Tax compliance. The app collects W-9 and W-8 tax forms to be able to withhold payment for non-compliant payees. This allows for the prevention of payment to illegal parties. In addition, the software creates forms with ease while computing for the right tax.

- Advanced Reporting. The product has an excellent payment reporting system, generating accurate payment reconciliation reports. This is done with minimal intervention from managers.

Detailed Tipalti Review

6. FreshBooks

FreshBooks helps users address recurring invoices and subscriptions easily. It supports online payment collection via credit cards, PayPal and Google Checkout. This piece of software integrates seamlessly with known business applications, allowing for streamlined processes. As it is a complete suite, the need for additional software is eliminated, providing users with absolute control over their financial operations all from a single dashboard.

To make the app even better, the vendor saw to it that its latest version has advanced functionalities to further improve the financial management capabilities of users. Its dashboard makes for easy customization while data security is not an issue as secure backups are regularly implemented to keep user information secure at all times. Charges are bound to be accurate using the system, which likewise allows the use of Android and iOS apps to track outside work times.

FreshBooks can be purchased in a variety of pricing models starting at $15/month.

What’s unique about FreshBooks?

- Simpler but powerful solution. The latest version of FreshBooks is designed to be simpler but advanced features were incorporated in the platform. A sleek interface now comes with the software and collaboration among team members is now promoted, resulting in higher work quality.

- Mobile optimized. FreshBooks comes with mobile add-ons for devices running on Android and iOS, enabling users to access information anytime, anywhere.

- Online payment. The tool’s time tracking capability is designed for use in billing, enabling businesses to get paid online through a variety of payment gateways.

- Impeccable invoice to payment. For small businesses, FreshBooks offers invoice to payment functionalities. Users can pinpoint the exact location where a customer opened an invoice email, very useful in catching customers who say the invoice never got to them.

- Billing history management. The platform hosts features that allow for the tracking of both past and current invoices. Unpaid invoices can be pulled out instantly using this functionality.

Detailed FreshBooks Review

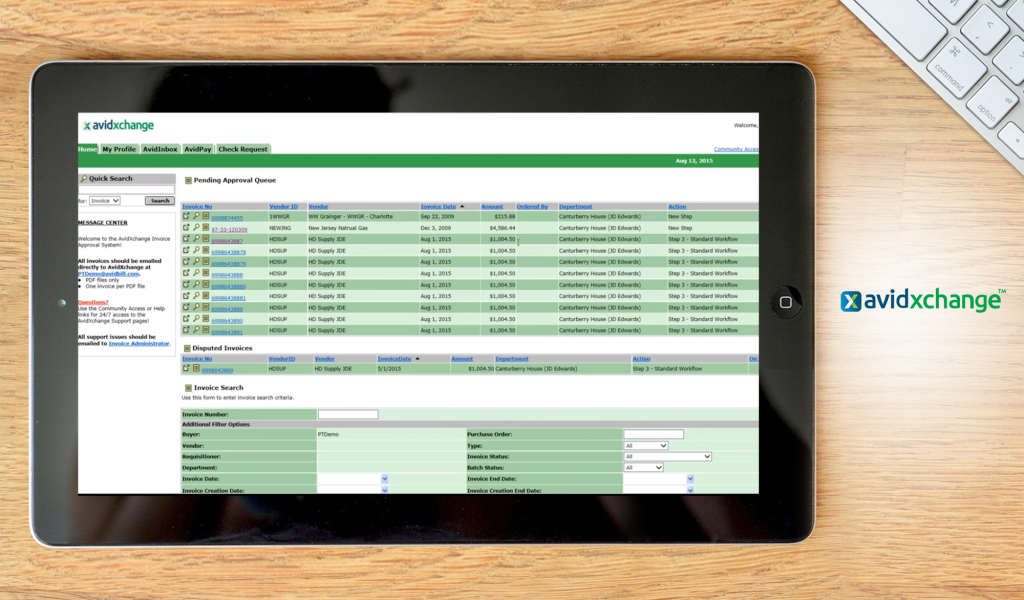

7. AvidXchange

AvidXchange is a finance platform designed to assist B2B companies in managing their accounts payable and bills payments. With this, you can effectively eliminate paper invoices. On top of that, you can save time by automating what would instead be protracted payment processes.

There are various other components as well that make the software holistic and capable of assisting you with all of your accounts and finances. A couple of examples are AvidXchange’s purchase order module and approval workflow. You can leverage the purchase order application to ensure that your business’s backend runs smoothly continuously with a steady supply of important materials. Meanwhile, you can utilize the approval workflow to make sure that your workforce gets the supplies they need quickly.

What is unique about AvidXchange?

- Made for B2B. The solution is popular among B2B organizations because it is designed for their use, specifically.

- Electronic invoicing. Paper invoices are wasteful, prone to errors, and can be easily misplaced or lost. AvidXchange resolves that with its electronic invoicing function, which saves you cost and helps you keep accurate records.

- Automatic bills payments. If you miss paying your bill even for a day, you can already incur penalties. You can avoid that by using the solution’s automatic payments function.

- Platform security. AvidXchange assures you that your data is safe in the event of system failures and natural disasters.

Detailed AvidXchange Review

8. Rossum

Rossum is an intelligent software accounts payable solution that comes with an all-in-one document management platform. This AI-powered platform takes accounts payable automation to the next level by eliminating 90% of manual processes. Rossum removes manual invoice data entry by bringing in its own computer vision technology that reads and captures all types of invoices with top-grade speed and accuracy.

All documents needed for your accounts payable, whether paper-based or electronic, are collected by Rossum from various sources including DMS systems and email inboxes. All documents are then filtered, removing duplicates, spam, and other unnecessary data for a clean curated collection of documented transactions. Sorting all documents is also made easier by Rossum’s cognitive data capture, which recognizes different types of invoices and every single piece of information that needs to be extracted from them.

Furthermore, Rossum’s AI engine is self-learning, which makes it adaptable to the changes in requirements and corrections in the processing of invoices and other documents.

What’s unique about Rossum?

- Self-learning AI. Rossum’s capability to adapt to the changes made in the process of invoice collection, data extraction, purchase order matching, and more makes it an even more ideal platform to make accounts payable operations more efficient.

- Cognitive data capture. This technology is unique to Rossum and is intended to imitate how the human mind detects and captures information from a document.

- Independent communication and decision-making. One of the biggest advantages of using Rossum is you no longer have to keep your business partners, vendors, suppliers, etc., regarding their invoices and other documents. Rossum automatically updates external parties regarding the status of the documents they have sent. And if there are issues in the documents sent, Rossum also automatically reaches out to other parties for clarification.

Detailed Rossum Review

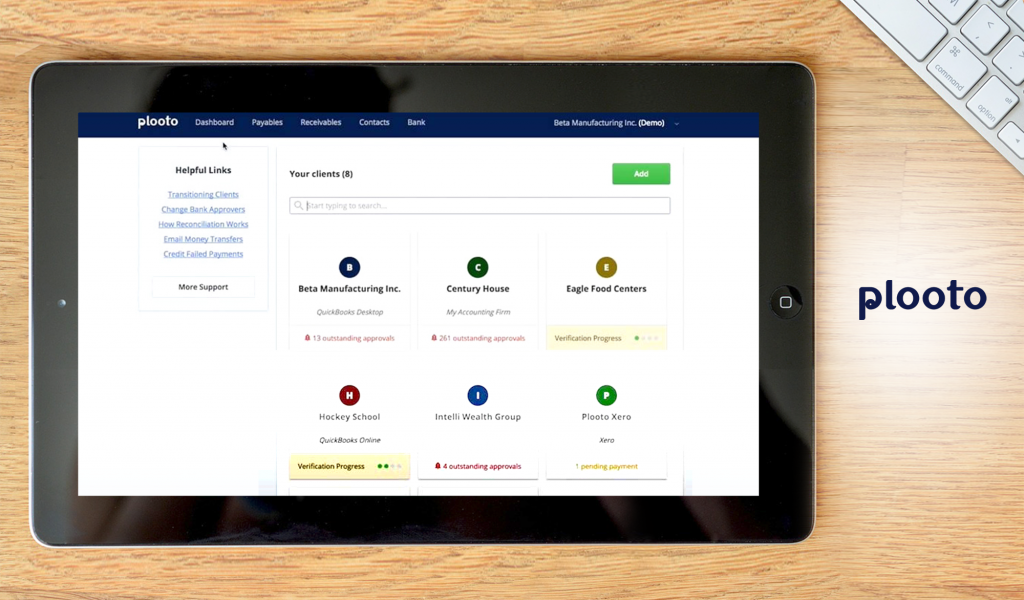

9. Plooto

Plooto is a powerful payment processing system that provides end-to-end AP/AR automation for accountants and bookkeepers. Handling all the facets of your cash flow is what this platform does best. It ensures that every bill is accurately paid without delay thanks to smart approvals.

Moreover, it allows you to stipulate approval tiers based on the bill amount and assign approval roles to your trusted lieutenants. It does all this without relinquishing control over the cash flow thanks to the audit trail and record-keeping tools. Not to mention, Plooto allows you to make electronic payments in more than 30 countries around the world. The vendor offers a comprehensive free trial to get you up to speed with the features.

On the other hand, Plooto is designed to facilitate fast and easy payments. Features such as the Pre-Authorized Debit (PAD) agreement offer an easy way to receive payments with less effort. That’s not all, the platform automatically imports invoices from your accounting software and sends a request for payment to your clients. It enables the client to make payments with ease and without sharing their bank details.

What’s unique about Plooto?

- Powerful approval workflows. Whether you have outsourced accounting teams or have remote payment approvers, there is nothing to worry about. Plooto’s approvals workflow tools and the customizable approval tiers work in tandem, allowing you to define clear roles for everyone to streamline the approval process and eliminate all bottlenecks.

- Audit trail and record keeping. With the audit trail, you can assign approval roles to different people and keep track of the entire process. The platform keeps details about each payment, so you can know who approved what and when.

- Automatic account reconciliation. In addition, Plooto works harmoniously with the existing accounting software. This way, when a payment is made or money is transferred to your account, the details are synchronized automatically into the accounting software. As a result, it instantly reconciles your books and requires no human effort to do so.

- Pre-Authorized Debit (PAD) agreement. An interesting Plooto feature designed to simplify payments for recurring bills. For example, with PAD and the recurring payment features, property managers can agree to have funds automatically deducted from the tenant’s account when rent is due. Every tenant receives receipts automatically and in case any of the payment is unsuccessful, the manager is notified to take appropriate action.

- Contact management. Moreover, Plooto makes it easy to manage the client’s contact information in a centralized system.

Detailed Plooto Review

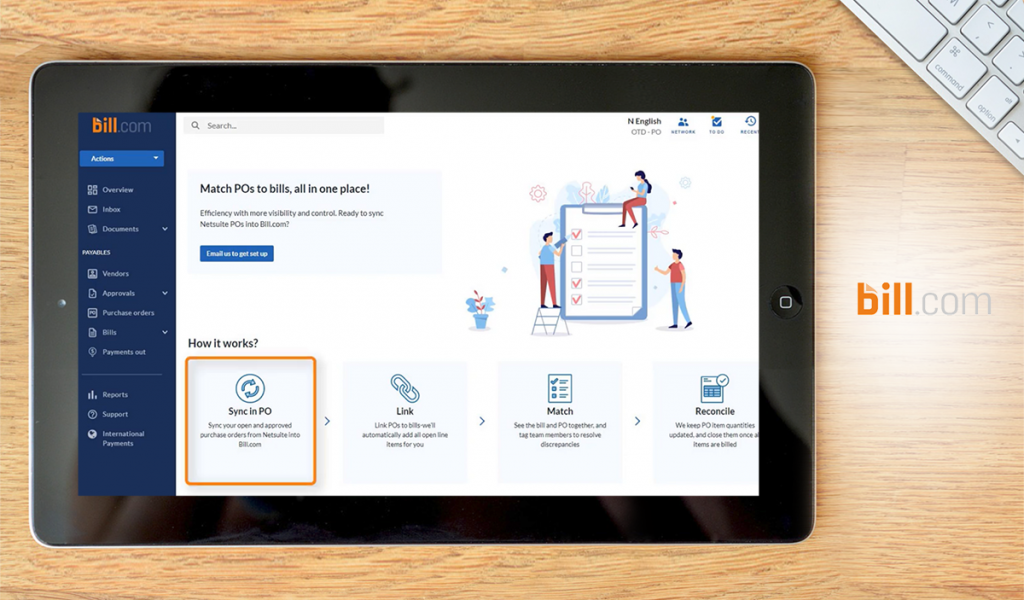

10. Bill.com

Bill.com simplifies managing records and accounting processes. With an AI-enabled system, financial transactions such as capturing invoices, approving payments, and managing cash inflows and outflows can all be done through the platform. This allows your company to connect with its customers, suppliers, and other business partners by focusing on the relationship rather than being bogged down with repetitive tasks.

It is a great choice for businesses of all sizes since it offers an all-in-one end-to-end solution. Banks, accountancy businesses, and wealth management organizations all utilize it to serve their clients. As such, it has earned a well-deserved reputation as a trusted business partner of some of the most prominent financial institutions, including some of the most prestigious accounting firms in the United States.

Bill.com offers various pricing plans starting from $39 per user per month.

What is unique about Bill.com?

- Leveraging the power of AI. The application minimizes time-consuming tasks so your team members can focus on what they do best. It can handle complex finance-related processes with accuracy without missing any deadlines.

- Simplified payments. Bill.com makes payments to vendors a breeze with four easy steps. Upload the invoice from your vendors, specify who needs to approve the transaction, choose the payment method, then pay.

- Get paid easily. Fast-track payments by sending professional invoices to your clients. You can track all your invoices right within the platform and even set up automated reminders, so you don’t miss anything.

- Seamless business workflows. Bill.com integrates with most productivity platforms to provide you with truly efficient processes. It works with Expensify, Tallie, Earth Class Mail, and more.

Detailed Bill.com Review

11. Tradogram

Tradogram is an easy-to-use platform that empowers businesses to make the best procurement decisions. Despite its intuitiveness, this application has powerful features that pave the way for reduced expenses, higher revenue, and quality supplies.

As procurement is a business process present in every industry, Tradogram can be used by any kind of company. Moreover, it is customizable, thereby making it a flexible solution for your procurement needs. It can also connect with your items database as well as external data sources for supplies.

Companies can enjoy the full benefits of Tradogram for only $15 a month for every user. However, if you have limited procurement needs, you can also opt to use the free version of the software.

You can use all the features for free for a period of time to see if the software matches your needs.

What is unique about Tradogram?

- Connected with suppliers. Tradogram is both an e-procurement and supplier management platform. This connects you with your suppliers, allowing you to get only the best materials or services for your organization.

- Spend management. Having access to the best does not mean you have to shell out huge amounts of cash. Tradogram’s spend management tool enables you to procure high-quality products while ensuring that finances do not go red doing so.

- Automated procedures. Tradogram saves you time with its automation capabilities, which apply to purchasing, sourcing, and supply chain management.

Detailed Tradogram Review

12. Yooz

Yooz is an accounts payable automation platform for large and small businesses alike. It offers end-to-end solutions using tools ranging from workflow management and real-time monitoring to purchase order creation and compliance tracking. This way, companies in various industries can streamline the way they handle their AP processes without the need for multiple software solutions.

Even though the platform has an easy-to-use interface, it is highly configurable and it comes equipped with advanced tools that allow users to have complete control over their processes. For instance, it makes use of fully customizable workflows and it has automated GL coding and PO matching. It also has multi-channel support, allowing users to perform their AP operations seamlessly.

In addition to the abovementioned, Yooz is powered by AI Deep Learning and Big Data technologies. With these, you can quickly capture and extract data from transactions and store them in one searchable database.

Should you want to further extend the functionalities of this platform, Yooz integrates with over 250 business systems. These include Sage, Plex, FinancialForge, Infor, and Accufund, among others.

What’s unique about Yooz?

- Easily Manages Accounts Payable Processes. Yooz is equipped with paperless automation options and lets you set up unlimited smart workflows. It can even connect with multiple channels so you can collect transaction information from all your touchpoints.

- Powered by AI Deep Learning Tech. Yooz utilizes artificial intelligence and robotic process automation (RPA) to help you accelerate data capture and extraction without compromising accuracy.

- Fraud Protection. The platform is equipped wth YoozFakeDetection as well as YoozPay so you can easily securely process payments and protect yourself from fraudulent transactions. Aside from detecting forged documents, it also has a traceability module and control rules for added security.

- Powerful Reporting. Yooz not only comes with real-time monitoring of transactions, it also has analytics and reporting options so you can gain insight into your transactions.

Detailed Yooz Review

13. DocuPhase

Docuphase is an organization-wide automation solution. While it is primarily known for document management and automation, it does have features that can help the finance and accounting teams. What’s more, regardless of their unique processes, DocuPhase can adapt to their custom configurations.

In particular, the platform can streamline accounting procedures through AP automation. It eliminates paper from the equation and can reduce processing times from weeks to days. DocuPhase also integrates POs in the workflow. With this, organizations can enforce more controls on the procurement process. Plus, payments are automated with the software so you do not have to worry about missing deadlines.

Since organizations can remove the burden of redundant tasks, it is possible for employees to focus more of their efforts on high-value work rather than menial tasks.

What is unique about DocuPhase?

- AP automation. DocuPhase eases the burden of dealing with accounts payables through its automation capabilities. Thus, it is easier to deal with manual and repetitive tasks.

- PO automation. As part of its automation workflow, DocuPhase also automates the procurement workflow. It can simplify the handling of purchase requests as well as the purchasing while ensuring that they adhere to procurement policies.

- Automated payments. It can be difficult to keep track of payment deadlines—and the penalties that come with late payments. That is why DocuPhase has a payment automation system. This way, you can pay your suppliers or vendors on time or even earlier.

- Easy audits. Audits are a headache—nobody likes doing them. But with DocuPhase, it is a process that can be dealt with quickly and with fewer setbacks.

Detailed DocuPhase Review

14. Zoho Books

Zoho Books is a smart accounting solution designed to manage small businesses’ cash flow and finances. It is known for its ease-of-use, helping users make intelligent business decisions. Being a part of the Zoho product stable, the product does not only offer hassle-free accounting but excellent support, uptime, and security as well. It is capable of sending customers professional invoices and even accepting payments online.

The platform is not just handy, it is also powerful, giving users absolute control over financial management. It has myriad useful features such as P and L, cash flow statements and balance sheets creation, to name a few. The dashboard is pleasant to the eyes and is able to display financial overviews and graphs. Aside from these, the solution is also capable of streamlining other back-office functions.

Zoho Books can be purchased in different pricing plans, starting at $9/organization per month.

What is unique about Zoho Books?

- Automatic bank feeds. Zoho Books imports all credit card and bank transactions, eliminating the need for manual data entry. These data are likewise categorized in accordance with bank rules.

- Automatic payment notifications. Users can come up with messages for clients, reminding them to pay on time and set their frequency that is convenient for both parties.

- Customer engagement. The app’s collaboration functionalities engage customers by making them feel that they are part of the payment process. This is done by providing clients with access to their invoices and estimates and allowing them to directly make payments online.

- Invoice distribution and tracking. The system helps users in the collection of prepayments and retainers. Invoices can be pulled off for individual estimates. Offline payments can be recorded and even linked to selected invoices and projects.

- Project management and tracking. Simply entering the time spent on projects into the system allows Zoho Books to record the expenses incurred on projects and invoice customers.

Detailed Zoho Books Review

15. SignRequest

Though it is an e-signature software, SignRequest can be a part of your business workflows, including accounting. By using electronic signatures, you can save time and resources. For one, there is no need to print, sign, scan, and resend documents. On top of that, you do not have to waste paper, ink, and electricity printing on actual paper, as you can sign digitally instead.

SignRequest adds another layer of security to your documents as well. That is because every document and signature that it processes is protected with SSL 256-bit encryption. And aside from your e-signature, you can sign documents using a GlobalSign digital certificate. This further strengthens the security of your data, safeguarding you from fraud.

This protection can be yours for as low as $9 a month. If you require advanced features, there are top-tier plans as well.

What is unique about SignRequest?

- Integration with any business process. SignRequest makes accounting more secure, as it can integrate with any business workflow.

- Resource savings. With SignRequest, you can affix e-signatures or digital signatures to documents. This abstracts the need to print papers just to sign them, letting you save a handful of resources.

- SSL encryption. SignRequest applies SSL encryption to every document and signature that passes through its system.

- GlobalSign. The platform adds another layer of security to your business proceedings by enabling the use of GlobalSign digital certificate.

Detailed SignRequest Review

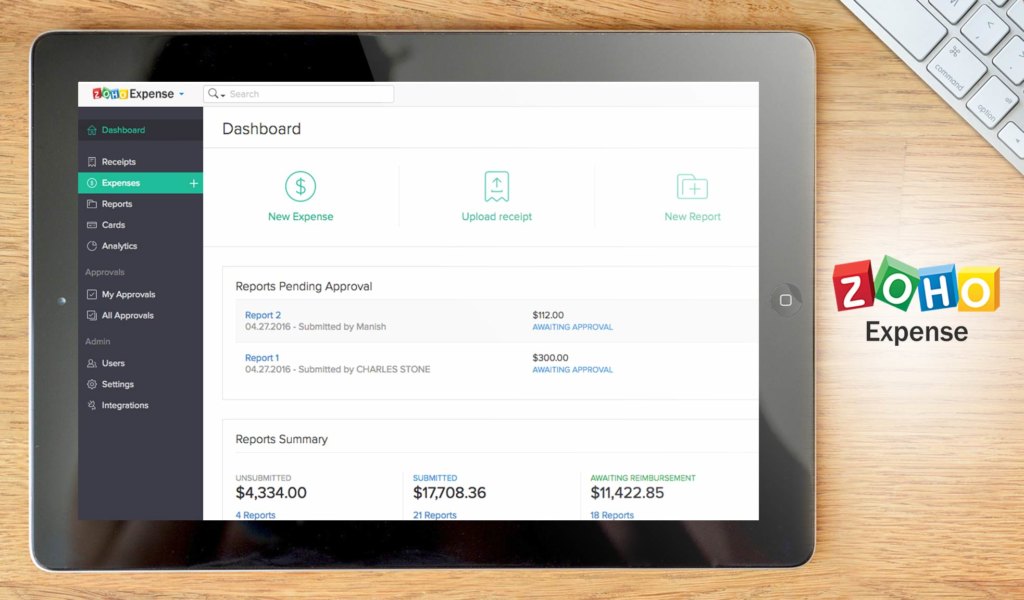

16. Zoho Expense

Zoho Expense is an accounting solution that is capable of making expense reporting and tracking far simpler. It can automate many expense management tasks while making a record of all financial transactions. With this piece of software, receipts can be converted into expenses, collated, from which reports can be generated.

The app can likewise capture expenses from credit card transactions, a very useful feature. It can be accessed at any given time and place as it runs on any device. Problems arising from spending limits and expenditures that are permissible are minimized, resulting in compliance and enforcement of companies’ spending policies. Popular integrations include Zoho Books and Zoho CRM, which allow users to utilize a single account for all tools.

Zoho Expense can be purchased at a single price model of $15/month. However, if more functionalities are required, contact the vendor for a customized quote.

You can use all the features for free for a period of time to see if the software matches your needs.

What is unique about Zoho Expense?

- Easy recording. Zoho Expense can easily record all company expenses in real-time, saving users valuable time. It allows for the syncing of credit card transactions, which can be accessed automatically. The smallest yet relevant detail can be included in such records.

- Expense reports. The solution can review and approve expense reports with the click of a mouse. Users are categorized as approvers, administrators and submitters, who play different roles in the system’s operations.

- Integration with other Zoho products. The system is ideal for users of Zoho’s productivity suite as it works well with Zoho CRM and Zoho Invoice.

Detailed Zoho Expense Review

17. FreeAgent

FreeAgent is a feature-rich solution intended to help small businesses and freelancers. It is relied upon by more than 60,000 businesses with its ability to bring together and manage all aspects of financial operations. The software comes with an array of tools designed to let you efficiently manage all important financial tasks and processes such as payrolls, taxes, expenses, estimates and invoices, bank transactions, cash flows, time tracking, and your project’s financial performance.

The software allows you to create, send, and track invoices; monitor expenses by simply taking a photo of your receipt and uploading it to the system; keep time records using a built-in stopwatch; and link to bank accounts with transactions imported automatically into the platform. The dashboard gives you full visibility over your business’ income, cash flows, expenses, profitability, and receivables. All these features make FreeAgent one of the best accounting software for small business to adopt.

It is easy to try its features at no cost and validate if this app is for you.

FreeAgent also provides seamless connectivity as it allows you to associate it with all of your bank accounts, or move numbers in and out with few clicks through its integration capability. In fact, it integrates with over two dozen third-party apps and services and supports more than 750 add-ons with Zapier.

Adding to its small business-friendly appeal is its low-cost pricing available in one universal plan of $10/month for 6 months, then just $20/month afterward.

What is unique about FreeAgent?

- Built for small businesses. The software is designed for small businesses as well as contractors and freelancers, providing them with all the accounting and financial tools they need.

- Intuitive navigation. Known as “Overview”, the dashboard features a sleek and modern interface that displays all important data and provides quick access to your invoices, projects, estimates, and timeslips.

- Advanced expense management. Small businesses can take advantage of an advanced tool normally reserved for more expensive solutions. You can have all expenses categorized by currency, linked to specific projects and activities, tracked, and documented once the invoice is paid.

- Facilitated payments. FreeAgent has enabled payments directly into the system, letting you attach links to all internationally applied payment systems in the invoicing templates.

- Expense tracking. The solution gives you the capability to track your businesses’ expenses with the use of bank feeds and imported bank statements as well as attach expenses to individual projects when billing customers.

Detailed FreeAgent Review

18. Sage Business Cloud Accounting

Cloud-based accounting and invoicing management platform Sage Business Cloud Accounting is designed to cater to small businesses. Its core functionalities include accounting, compliance and expense management. What sets Sage Business Cloud Accounting apart from its sister app Sage 50c is that the former is an add-on service that allows for the integration of the latter to the cloud, resulting in cloud storage and accessibility for all your accounting data. This combination makes Sage Business Cloud Accounting better than ever.

The system’s graphs, dashboards, and transaction overviews offer users a vivid idea of how their business is doing anytime, anywhere. It can generate histories of purchases and sales and bank statement imports, which are very useful in managing cash flow. The app can be accessed via smartphones, giving users a real-time view of customer data and letting them record notes at any given time.

Sage Business Cloud Accounting is being offered in two pricing models, starting at $30/month.

What’s unique about Sage Business Cloud Accounting?

- Accounting tool for small businesses. Sage Business Cloud Accounting is targeted at small businesses, allowing them to manage all tasks related to accounting. It helps users manage payment processes like estimates, invoicing and price quotations. It also comes at flexible pricing terms, making it ideal for businesses on a tight budget.

- Cloud storage and accessibility. The app’s integration with Sage 50c provides it with cloud storage capability and gives users access to all accounting data

- Robust features from a single dashboard. The platform makes users’ accounting information all available from its dashboard, keeping them informed on receivables and cash flows.

- Tax management. Sage Business Cloud Accounting also serves as a tax management tool, able to calculate taxes accurately based on transaction information. It can forecast cash flow, allowing users to estimate cash requirements.

- Mobile optimization. The platform comes with Android and iOS apps, which can be used in the creation of invoices, expense recording and in viewing graphs reflecting business performance. Integration with third-party apps is also possible.

Detailed Sage Business Cloud Accounting Review

19. Sage 50cloud

Sage 50cloud is an online accounting solution designed to help small and medium-sized businesses manage their financials and stay compliant with taxes and reporting requirements. It comes with all essential features expected of a best-in-class accounting platform such as taxes, inventory, budgeting, cash flow, and invoicing. In addition, you get a wide range of add-ons including credit card processing, HR/payroll, POS, e-commerce, data management and more. With its mobile capability, you can make payments on-the-go and bill customers, and provide your accountants real-time access to accounting books.

A distinctive attribute of the accounting platform is that it combines the robust feature set of a desktop tool with the accessibility of the cloud. This hybrid set up lets you access and store data in the cloud while doing other tasks in your local machine. You can use the software to track purchases and vendors and pay bills while its expense management features let you undertake mobile payments and bank feeds. It also allows you to connect to your bank accounts, providing for real-time recording of sales and receipts, tracking receivables, transferring funds, reconciling bank accounts, and making deposits.

Sage 50cloud offers three pricing plans starting at $44.97/month. It also has a 60-day risk-free, money-back guarantee.

What’s unique about Sage 50cloud?

- Powerful & convenient hybrid solution. It gives you extreme flexibility by combining the power of desktop software and the convenience of the cloud with an array of 50 features to manage your financial business operations and requirements.

- Bank-level protection. You’ll have your finances safe and secure with screen-level user access and bank-level online protection to keep your critical information safe.

- Designed for SMBs. With its enterprise-grade features, the software is kept affordable and within reach of small and medium-sized businesses, making it the accounting solution of choice by over 7 million customers in 23 countries.

- Accounting made easy. You don’t have to be an accountant to organize your business and get ready for tax season with its built-in checks and balances to ensure your financials are accurate and are available anytime and anywhere for you and your accountant.

- Training & support. Explore the Sage University for on-demand learning topics and comprehensive instructor-led classes. You also get 24/7 access to support articles and other resources from a comprehensive knowledge base.

Detailed Sage 50cloud Accounts Review

20. Invoiced

Invoiced is a cloud-based software for automating accounts receivables. Easy to use with a straightforward dashboard, it is designed to ease the automation of collections and streamline payments of businesses. This cloud-based solution helps companies automate repetitive accounting tasks to free up the accounting department to focus on other jobs. Upfront, a user-friendly, straightforward dashboard lets users access controls, menus, and tools for customization. Invoiced allows you to create invoices, see customer payment history, monitor analytic reports such as fastest/slowest to pay clients as well as key AR metrics. On the billing side, the software enables your billing department to create estimates, set rollover rates and volume-based pricing, as well as present rates with promotions and discounts.

Invoiced is a cloud-based software for automating accounts receivables. Easy to use with a straightforward dashboard, it is designed to ease the automation of collections and streamline payments of businesses. This cloud-based solution helps companies automate repetitive accounting tasks to free up the accounting department to focus on other jobs. Upfront, a user-friendly, straightforward dashboard lets users access controls, menus, and tools for customization. Invoiced allows you to create invoices, see customer payment history, monitor analytic reports such as fastest/slowest to pay clients as well as key AR metrics. On the billing side, the software enables your billing department to create estimates, set rollover rates and volume-based pricing, as well as present rates with promotions and discounts.

Four interconnected modules: Invoice-To-Cash, Subscription Billing, Payment Plans, and Customer Portal, comprise the platform created to make all your collection activities as seamless as possible. Invoiced also gives your customers more options for paying as it integrates with multiple channels for payment and online payment systems.

Invoiced offers a 14-day free trial while its Basic Plan is priced at $100.

What’s unique about Invoiced?

- Customization and visibility. The software enables you to create invoices and estimates, set rollover rates, and volume-based pricing. Optimized visibility lets you monitor analytic reports and customer payment history quickly and easily.

- Straightforward dashboard. The Invoiced dashboard is simple and easy to navigate, putting all the necessary controls as well as tools for customization within quick access.

- Interconnected modules for seamless collection. Invoiced puts together Invoice-to-Cash, Payment Plans, Subscription Billing, and Customer Portal for truly seamless collection activities. .

- Secure online traffic. The software uses HTTPS with TSL encryption for secure online traffic and communications.

Detailed Invoiced Review

Cloud Accounting Software is the Future, the Future is Now

So, there you have it; our top 20 accounting software for small business for 2026. However, if you are a Mac user, you may want to check out our top 20 accounting software guide for Mac. There are slight changes when it comes to ranking, however, the best ones will always be cloud accounting platforms.

This is because, if you want to move forward with your accounting practice, cloud platforms give you the best value for your money. They don’t only provide you with tools that you can easily personalize, but they also provide you access to friendly developers and lively user communities that can help you with your journey.

Furthermore, unlike on-premise platforms, cloud accounting software solutions are easily scalable. They are designed to fit your growing needs. This is thanks to a modular deployment that you can easily scale up or down when you need to. These are just some of the many reasons why more and more businesses and professionals are adopting cloud-based tools.

As much as this brief review of the leading 20 accounting software for your small business has given you helpful insights into these platforms, nothing beats a firsthand look and feel of the application you have in mind. As most of the solutions featured here offer a free trial period, why not grab the line and test-drive the application to see how it works in real time? You can start with our top choice and use its feature set as a benchmark. Sign up for NetSuite ERP free trial and get your research rolling.

Key Insights

- Cloud Adoption Surge: The COVID-19 pandemic significantly accelerated the adoption of cloud-based accounting solutions, emphasizing their importance in maintaining agility and operational continuity.

- Comprehensive Solutions: Many of the top accounting software for small businesses, like NetSuite ERP and QuickBooks Online, offer a wide range of features beyond basic accounting, such as invoicing, payroll, and inventory management.

- Scalability and Flexibility: Solutions like Sage Business Cloud Accounting and Zoho Books are designed to scale with the growth of a business, offering flexible modules that can be added as needed.

- Automation and Efficiency: Platforms like Bill.com and Rossum focus on automating repetitive tasks, such as invoice processing and accounts payable, to free up time for more strategic activities.

- Integration Capabilities: Many of the top accounting tools, such as Zoho Expense and Plooto, offer robust integration capabilities with other business systems, enhancing overall operational efficiency.

- Security and Compliance: Tools like Tipalti and SignRequest prioritize data security and compliance, ensuring that businesses can safely manage financial transactions and sensitive information.

- User-Friendly Interfaces: Solutions like FreshBooks and FreeAgent emphasize ease of use, making them accessible to users with varying levels of accounting expertise.

FAQ

- Why should small businesses consider cloud-based accounting software?

Cloud-based accounting software offers flexibility, real-time access to data, and scalability, making it easier for businesses to manage finances from anywhere and grow without significant IT infrastructure investments. - What are the main benefits of using accounting software for small businesses?

Accounting software streamlines financial processes, improves accuracy, saves time on manual tasks, enhances financial reporting, and helps ensure compliance with tax regulations. - How do I choose the right accounting software for my business?

Consider factors such as the size of your business, specific accounting needs, budget, ease of use, integration capabilities, and customer support options when selecting accounting software. - Are there free accounting software options available for small businesses?

Yes, some accounting software, like Zoho Expense and FreeAgent, offer free versions or trials that can help small businesses manage their finances without upfront costs. - Can accounting software integrate with other business systems?

Many accounting software solutions offer robust integration capabilities with other business systems like CRM, ERP, payroll, and e-commerce platforms to streamline operations and data management. - How does accounting software help with compliance?

Accounting software helps with compliance by automating tax calculations, ensuring accurate financial reporting, and providing tools to track and manage regulatory requirements. - What is the importance of automation in accounting software?

Automation in accounting software reduces the need for manual data entry, minimizes errors, speeds up financial processes, and allows businesses to focus on more strategic tasks. - Can accounting software handle international transactions?

Yes, many accounting software solutions, like Tipalti and Airbase, support multiple currencies and international transactions, making them suitable for businesses with global operations. - What kind of customer support can I expect from accounting software providers?

Most accounting software providers offer various customer support options, including online resources, live chat, email support, phone support, and dedicated account managers for personalized assistance. - How secure is cloud-based accounting software?

Cloud-based accounting software typically employs advanced security measures such as SSL encryption, two-factor authentication, and regular backups to ensure data protection and security.

A concise and informative comparison that helps small businesses choose the right accounting software with clarity and confidence.

I strongly agree that solid accounting foundation is key to growing the company. I think that not only accounting brings more customers, huge staff and a bigger operational budget, along with bigger headaches in balancing the sheet. I think that other programs can do it too. As we have accounting softwares which works fine, in my company we like to use also other software programs. I think that accounting software can do just a little impact for company... So it is better also have some programs as Asana, something for CRM, Slack, NordVPN Teams or even password manager.

Accounting is a risky word in some offices. And it makes to why: We think of financial management as a complex beast. But as the days of paper drawers and classic

spreadsheets fade away, things are changing. Accounting software ranges from basic invoice creation and expense-tracking, advanced financial

reporting, and inventory management. When choosing the right accounting app for your business, it's important to work backward in terms of your current processes,

future goals, and budgetary constraints.

I am restarting in the accountancy business after a 10-year break. The biggest change is the technology of course and we now have a proliferation of cloud products. I used to deal with only Sage, but now the market for app's has really opened up. Alex, what would you consider the best software at the moment for someone like me? I've heard a lot about Quickbooks, but Sage seems to have caught them up with their interface. What I'm looking for is an app which allows for accountants with clients. Multi-currency facility has to be a must, but inventory, or project capability not so much so.

Any suggestions?

Stuart

I'm looking for a cloud based application that can help with a service based business. Specifically a yoga studio. There are no invoices to generate because clients pay at the time of service. I need to track expenses and income. No employees to pay. All instructors are contracted labor. I like the idea of snapping a photo of a receipt and the software saving it to the correct expense category. I'd also be interested in something that could accept multiple forms of payment. PayPal, Venmo, etc. Along with credit cards. Any suggestions?

Which of the five systems analyzed supports a manufacturing environment best?

Frankly, I’d think twice before entrusting financial data to a free-to-use service, probably even the freemium ones you mentioned. To make my point clear, I have nothing against cloud-based technology, in fact I could not imagine doing business without my smartphone, but when it comes to financials I still vote for local hosting. No bad experience with these solutions though, the choice’s up on you!

You are absolutely right to believe that sensitive information must only be entrusted to reputed and premium providers. However, the affordability of a system and the safeguarding of customer data are not mutually exclusive, as this is how all vendors turn first time users into loyal clients.

Security matters are among our prioritized criteria when comparing and listing suggestions, and they played a role when picking the 5 products above. They all use bank-grade data encryption technology and comply with leading safety regulations, and will assume full responsibility on eventual safety breaches as soon as you become their client. With data being hosted in cloud, and accessible only with valid credentials, you won’t risk losing it even if something happens to your device. With locally hosted solutions, however, you will need a dedicated team to work around your security network, and to keep an eye 24/7 to prevent a crash or an intruder.

Plus, most of these systems offer additional security layers to be managed on your behalf, including 2-factor authentication, role-based access, audit logs, and a historical overview on all changes being made to your data.

I am using Xero for three years already, and I never encountered a security issue. I’ve logged in from several devices, and each time I got a unique code sent to my mobile phone to access the account, there is no way to get around that. From what I know, they are also backing up data on several locations, so I see no reason for you not to consider it.

We are running a local gardening service business, and weren’t exactly lucky picking up a standalone billing service. We looked mostly at tools with multiple levels of service, but we couldn’t find an SMB-friendly plan that automates accounts payable. Pay-as-you-go was not an option either, as we’re working more or less with the same clients. Which system would you suggest?

It is exactly SMB-friendly accounting systems that invest the most in efficient billing & invoicing technology, as larger companies are usually looking at tools they can integrate with their bank service providers, and handle payments from their original accounts. The challenge is, as you noticed, to get a standalone and restrictions-free product, or at least one where you don’t have to pay recurring fees each time you cross a predetermined limit.

Looking up the list, we’d probably begin with Wave - their billing & invoicing services may not have the bells & whistles QuickBooks does, and you may not be able to infuse that much branding material in your docs, but they’ll get the job done for free. Zoho Books is the next-to-the-best service, as it lets you bill 25 clients for as much as $9 a month. FreshBooks, QuickBooks, and Xero are slightly more expensive (pricing starts at $15) and restrict their low-tier package to a smaller number of billed clients, but they will suit you perfectly if you want to customize and categorize invoices, and to report on your billing activity.

Note that all five providers on this list offer a free trial of their product, and you can test them in advance to pick the right solution for your needs.

As a freelance accountant I’d say it is not as easy to take advantage of SMB tools as their vendors like to put it. As a matter of fact, I’ve tried several of those myself, but still had to work around them to make sense of my data, and they didn’t get much further than spreadsheets, to be honest. Does any of these systems actually fit sole accountants?

You are right to assume that accounting technology designed for freelance and corporate use is rarely the same, and without knowing this, it is more than likely to end up paying for features one doesn’t need. The good news is that You, as a sole accountant, are not excluded from the best-in-breed accounting landscape!

Many of the systems we’ve reviewed are just cut for freelancers, with configurable billing & invoicing, automated tax calculations, integration with all major banks, and of course - reports and metrics that comply with your needs. A large portion of them are also extremely affordable, but so that you stay on the safe side, we recommend you to look exclusively at online and cloud-hosted technology. Pick natively integrated systems instead of hiring a developer to build software connections from scratch, and pay attention to scalability so that your prospective system can handle sudden workload spikes.

At this point, you shouldn’t exclude any of the products discussed in this list, but rather compare their features in detail to determine which one works the best for you. We’d probably hit off with FreshBooks or Wave, as they both offer a no-commitment freemium plan, and you can check whether they fit without investing in them.

I enjoy using Wave Accounting. I started with them and then moved to QB Online and then went back to Wave Accounting. It has improved a lot over 5 years, I highly recommend it!

Leave a comment!