If you are still relying on spreadsheets in billing your clients, then you are no stranger to complications that arise from unclear invoices, billing errors, and delayed payments. Also, with the many changes in legislation, tax laws, and specific codes for billing COVID-19-related services you might be providing to your clients, it has become even more crucial to use billing and invoicing software with modern and up-to-date features that can help you meet today’s billing and accounting requirements.

In this article, we will present some of the best billing and invoicing software on the market today. With these, you can automate your invoicing processes and even streamline your transactions. Some of them are stand-alone invoicing apps, while others are integrated into full accounting systems. To help you decide with clarity which products fit your business, we highlighted their pros and cons. You should be able to recognize their benefits quickly and even be able to shortlist your options after reading this article.

What are the 10 best billing software systems?

Billing and invoicing needs differ significantly from one company to the other, but what is very common in the corporate environment is to look for billing software that eliminates manual entries and automates routine operations to cut time consumption. This is especially because it takes an average of 8.3 days to process a single invoice, which means it will keep your employees away from more attention-demanding tasks.

Moreover, with so many businesses and their employees forced to shift their operations online or work from home due to the COVID-19 health crisis, mobile capabilities that allow users to access a system from any location and on any device have also become a necessity when shopping around for billing software.

Fortunately, many vendors are also stepping up their game and developing top invoicing tools designed to make invoice creation easier through automation. And because 49% of small businesses have been found to have a hard time following up on late payments while 46% have problems with timely payment, investing in such a system makes perfect sense. Apart from these, electronic billing helps businesses avoid errors.

While it is almost impossible to discover a one-size-fits-all billing software system, there are those that cater to most vertical industries, and incorporate configurable methods for payment collection to ensure usability in different markets. These systems have been helping companies, big and small, ensure billing accuracy and timely bill payments by improving the way they handle billing. This has resulted in the wide use of the platform, as can be seen in current electronic invoicing trends among many companies.

1. NetSuite ERP

NetSuite ERP is a powerful solution designed to help businesses streamline mission-critical processes. The platform provides all the tools a business needs to drive accounting innovation and accelerate growth. One such tool is the SuiteBilling, a leading billing solution that provides a unified order to billing to revenue billing framework. The solution boasts robust billing tools to support multiple business models, including service, product, time, usage, subscription, or hybrid models.

NetSuite’s SuiteBilling is an agile solution that automates pricing and packaging, invoicing, and automated rating processes. It places billing at the heart of the business; thus instilling unrivaled control over revenue management and billing operations. Moreover, the solution provides insights into audit logs, change tracking, total contract value, recurring revenue, and customer churn.

The vendor offers a comprehensive free trial to get you up to speed with the features.

Pros

- Consolidated invoices. NetSuite ERP’s SuiteBilling streamlines consolidated billing, including subscription, onetime, and project-based charges.

- Multiple billing models. Additionally, the platform allows businesses to bill their customers in multiple ways, including tiered, volume, and flat pricing models.

- Unique rating models. Besides, with SuiteBilling, it is easy to create subscription billing structures that include license counts, setup fees, and variable consumption.

- Realtime reporting. Even better, the solution allows businesses to generate real-time reports, including change tracking reports and audit logs.

- Price changes scheduling. Most importantly, it is a breeze to schedule changes in subscription and pricing, which includes precise dates and prorating.

Cons

- Offers limited integrations with third-party business applications.

- The implementation isn’t straightforward, especially for non-technical business people.

- Their support isn’t user-friendly.

Detailed NetSuite ERP Review

2. PayEm

PayEm is a global spend and procurement platform with bills payment features which provides users with a central location from where to process payments. With PayEm, you can upload vendor invoices, route them for approval to internal stakeholders, and create a bill from an invoice. You can also schedule ACH or international wire transfers for more than 200 territories and in 130 currencies, eliminating the cost and complexity of arranging for global payments. The system automatically calculates when you need to send a payment to make sure that it is received on time. It’s also possible to automatically set up and schedule amortized payments for bills. Amortization templates are available to be imported from NetSuite so you don’t have to set it up manually. With all these features, you can gain efficiency and control of your billing process while saving money for your team.

Pros

- Connect your finance processes. PayEm is a comprehensive solution that encompasses spend management, corporate cards, reimbursement, fund requests, and more. All these functions are accessible from one platform so finance teams have complete visibility and control over their processes.

- Built for global teams. PayEm is capable of cross-border payments so you can pay vendors, suppliers, contractors, freelancers, and publishers no matter where they are in the world. Beyond payment processing, vendor details and transactions can be automatically synced with your ERP to avoid double entry.

- Flexible payment options. PayEm can process payments through wire, ACH, and credit cards. Spend management can also be done through virtual or physical cards for employees and vendors. These cards are customizable so they conform to your business needs and company policies.

Cons

- PayEm does not offer fixed pricing packages. You would have to contact the vendor for a quote.

- PayEm does not offer a free trial that allows potential clients to test-drive the software. They can however, book a demo with the vendor.

Detailed PayEm Review

3. FreshBooks

FreshBooks can respond to the most important accounting needs of both small and large companies as it eases and tracks collection in a very reliable manner. Its intuitive interface makes it easy to use even for non-tech savvy users. FreshBooks offers a fully-featured invoice-to-payment suite where you can set due dates, charge late fees, brand invoices, send overdue reminders, and track billing.

On top of these, FreshBooks saves all your billing history, reports on profits and losses, and handles taxation issues. If you want to try out this solution first, there is a great free trial plan available (no credit card required). You can use all the features for free for a period to see if the software matches your needs.

Pros

- Unified financial control. With FreshBooks, you can manage invoices and collect payments on the same platform

- Simple and intuitive interface. FreshBooks has a modern and easy-to-navigate interface for natural collaboration and automates task prioritization.

- Full invoice-to-payment suite. With FreshBooks, you can set invoice due dates, track billing and charge late payments, and collect finances, making sure all taxation issues are taken into account.

- Tracking expenses. In FreshBooks, you can log expenses with a single click, track them daily, and use them for reimbursement deals.

- Powerful reporting. FreshBooks processes data automatically, generates expense reports and balance sheets, and summarizes taxes.

- Convenient pricing. FreshBooks’ monthly payments depend exclusively on the number of active clients in the system.

- Integrations with a large number of third-party apps and leading credit card providers.

- Fully functional mobile apps. FreshBooks helps take finances out of the office, allowing you to access records and do accounting on Android and iOS devices.

Cons

- No invoice tags. Unfortunately, FreshBooks doesn’t offer invoice tags that could help customers find the invoice they’re looking for.

- It doesn’t record non-billable expenses. For the moment, non-billable expenses should be entered into the system manually.

- There is no Free Plan for small teams and sole accountants.

Detailed FreshBooks Review

4. Salesforce CPQ

Salesforce CPQ is a straightforward software that can handle your billing needs with ease. Its combination of features streamlines processes involved in the entire sales process, including invoicing and billing. Thanks to its intelligent framework, it only takes a few clicks to find, select, and configure billable products and services, indicate prices in orders, and complete invoices.

Aside from billing capabilities, Salesforce CPQ also offers tools and features that help users deliver customer-friendly quotes. For instance, its pricing and discount module can handle multiple pricing and discounting settings. These include volume discounts, pre-negotiated contract pricing, and partner pricing. With these, users can stay consistent with their pricing and discount rules, which help simplify the billing process even further.

Pros

- Consolidated financial processes. Salesforce CPQ combines invoicing and billing into one easy-to-use platform.

- Easy to use interface. Salesforce CPQ has an interface and dashboard that is easy to navigate and get accustomed to.

- Complete invoice to billing experience. With Salesforce CPQ, you can set up invoices, send bills, and manage payments without leaving the Salesforce Cloud.

- Contract management. In Salesforce CPQ, you can track and manage contracts.

- Robust reporting and analytics. Salesforce CPQ allows you to analyze orders and cash flow better with its reporting and analytics features.

- Comprehensive integrations. As part of the Salesforce suite, Salesforce CPQ integrates with other Salesforce tools as well as other business systems.

Cons

- Order form generation can be a bit tricky when there are changes in subscription details.

- It requires careful specification of workflows to ensure a smooth billing process.

- It doesn’t come with a free plan.

Detailed Salesforce CPQ Review

5. vCita

All-in-one vCita is a suite of powerful tools that include scheduling and calendar, billing and invoicing, CRM, and marketing solutions. Built primarily for small businesses, consultants, and local service providers, the solution’s expansive capabilities enable users to manage their day-to-day business activities from a single interface. Particularly, businesses looking to streamline billing will find the billing and invoicing module to be quite capable.

The module provides easy-to-use tools that enable business owners to quote, invoice, and bill their customers. The beauty of it all is in the ease with which users can create invoices, estimates, and receipts. Besides, vCita speeds up billing and allows clients to make payments online via PayPal or credit card. Moreover, business owners can set up automatic client reminders for late payments to minimize time-to-payment.

Should you want to investigate the platform firsthand, all you have to do is sign up for the vendor’s free trial plan.

Pros

- Simple online payments. vCita allows you to accept payments online through PayPal and credit cards.

- Powerful billing and invoicing. Besides, the solution offers all the tools you need to create and send invoices, track payment status, issue estimates, create coupons, and collect credit card payments.

- Intuitive client portal. Even better, vCita comes with a user-friendly client portal that offers the tools clients need to book appointments, make payments, share files, and more.

- Reliable marketing module. vCita enables business users to create and run marketing campaigns to capture more leads.

- Lead capturing. Additionally, the lead capturing widget makes it easy to capture and nurture leads and increase customer satisfaction.

Cons

- Its integration with third-party CRM systems isn’t straightforward.

- vCita customer support isn’t the easiest to reach.

Detailed vcita Review

6. Zoho Invoice

Integrated billing and invoicing system Zoho Invoice takes on a wide range of functions to help small and midsized businesses with invoicing and expense management. Equipped with a library of templates, the platform allows for the creation of professional-looking quotes and invoices in just a few minutes. The templates are customizable, allowing users to apply logos and company colors, and can be sent through multiple channels. These include email, SMS, and the system’s client portal. In addition, Zoho Invoice tracks the status of each invoice and can be set to automatically send payment reminders.

More than just an invoicing solution, Zoho Invoice has a tool that monitors work hours and their corresponding financial value, along with unbilled hours. This enforces accuracy in the figures. The platform also has an expense tracker that zeroes in on unbilled expenses, which enables users to auto-scan receipts. To complete transactions, Zoho Invoice integrates with multiple payment gateways, including PayPal, Stripe, and Forte. Moreover, it has a portal through which clients can make payments, check estimates, and view invoices. Best of all, the system is absolutely free.

Pros

- Customizable templates. Zoho Invoice has a library of templates with which you can prepare professional-looking quotes and invoices. The invoices support multiple currencies.

- Intuitive estimates. The platform accounts for your pricing, discounts, and terms and conditions that may apply. It also presents your estimate history in case previous plans are given a go signal.

- Comprehensive client portal. Zoho Invoice features a client portal through which your clients can conduct all their transactions. These include sending payments and viewing invoices.

- Automated integrated payments. Zoho Invoice integrates with more than 10 payment gateways and can be set to auto-charge recurring payments. Notifications are also automated.

- Reliable expense management. The system tracks all your billable expenses and can convert them into invoices with just a click. It also monitors your working and unbilled hours, even your travel expenses.

Cons

- Lacks live support. Any concern regarding using the platform won’t be resolved instantly since it doesn’t offer chat support.

- Spotty custom reports. There are instances when the system’s reports fail to successfully unify manually entered information with automatically generated data.

Detailed Zoho Invoice Review

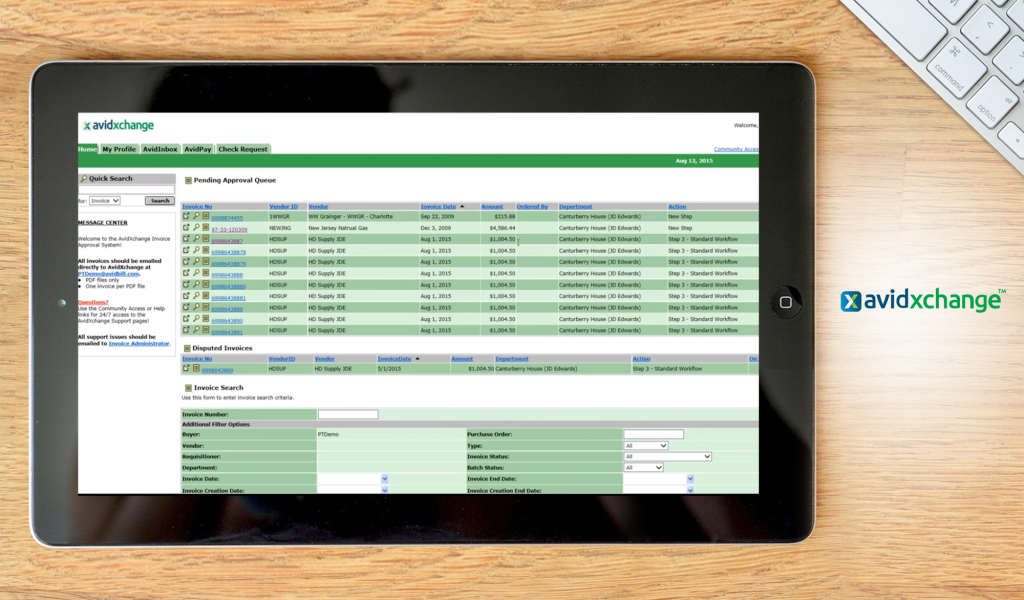

7. AvidXchange

If you are a startup company with a small team or without a fully operational accounting department, AvidXchange can help you efficiently handle your invoicing and bills payment process. It includes automation features that can make it easier for your staff to keep track of the status of each invoice so that you’ll know which ones need to be processed first and which ones have been sent out to clients. For your own bills payment, you can also manage them automatically in the platform and pay your suppliers and vendors through online payment systems.

AvidXchange has more than 180 integrations with ERPs and popular accounting software. Thus, if you are using other accounting apps, you can seamlessly connect AvidXchange to your current system and use the workflow that your team or employees have been used to. Connected systems mean reduced manual touchpoints and improved efficiency.

Pros

- Invoice automation. You can receive, track, and approve invoices using customized and automated approval workflows.

- Paperless invoicing. You can save time on signing, stuffing, stamping, and sending stacks of paper checks. Review, code and approve payments all in one digital place.

- Remote access. The platform is cloud-based, so your AP team members, managers, and supervisors can access important company records even if they are out of the office.

- Reduce fraud. Since AvidXchange is paperless invoicing, you can have better control over unauthorized payments and transactions.

- Integrations. AvidXchange has more than 180 interactions with leading ERP and accounting software.

Cons

- No free trial. Unfortunately, the vendor does not offer a free trial at the moment. The pricing plan of AvidXchange is also by quote only, so you would need to contact the company directly to have an idea of what your specific plan might cost.

- Limited reporting customization. Users have access to reporting features; however, customization can be limited if you want to obtain specific sections of reports.

Detailed AvidXchange Review

8. Sage Business Cloud Accounting

Formerly Sage One, Sage Business Cloud Accounting is known for its ease-of-use. It is an add-on service designed to give Sage 50Cloud the ability to integrate with the cloud, giving it great accessibility and secure storage. The system comes with a powerful dashboard that can generate visuals that reflect your transactions and, therefore, a bird’s eye view of how your business is performing.

Sage Business Cloud Accounting can run on any smartphone, allowing you to access client data and record transactions from any iPhone or Android device. Readily come up with quotes, which can immediately be sent to customers, who you can likewise contact directly using the app. For small businesses, the app offers expense and income tracking. Its dashboard is easy to navigate, not to mention highly-intuitive. These and more make the product one of the top accounting software solutions currently in the market.

The vendor has an appealing free trial where you can tinker with the features at no cost.

Pros

- Small business-friendly tool. Sage Business Cloud Accounting is designed to cater to SMBs, giving them features, such as expense management, accounting, compliance management, and project accounting capabilities, among many others.

- Easy access to accounting information. The tool makes it easy for you to access all your accounting data using a single dashboard. This allows you to always stay in the know when it comes to receivables and cash flow.

- Tax management. It can calculate applicable taxes based on your transaction information.

- Intuitive interface. The interface that comes with the software is easy-to-use, with all the needed features available in an instant.

Cons

- Internet-dependent app. The system can be prone to slowdowns when hooked up to a slow Internet connection.

- Does not conduct direct backups. Sage Business Cloud is unable to generate direct account backups. Backing up requires report printing.

Detailed Sage Business Cloud Accounting Review

9. Melio

Melio is a cloud-based billing and accounts payable software that is free to use, no monthly subscription is necessary. The software lets you conveniently pay bills via bank transfer or credit card. Payments via bank transfer are free of charge while payments via credit card will have a transaction fee of 2.9%. It is currently available to small businesses in the United States.

With Melio, you can set automatic payments using the scheduling features so you don’t have to worry about late payments or paying too early. You can also customize payment approval workflows so your accounting team can access the platform while you or an authorized manager stays on top of approving payments.

Moreover, you can pay via bank transfer even for vendors that only accept checks. Melio takes care of depositing or mailing checks to vendors for you with no delivery charges. Since Melio is cloud-based, you can access the software from any device such as a laptop, tablet, or mobile phone. This makes it convenient for small business owners who are on the go and might need to access their billing system at different locations.

Pros

- Flexible payment options. You can pay via bank transfers (ACH), debit cards, and credit cards. Bank transfers are free of charge while credit card payments will incur a 2.9% transaction fee.

- Check payments. You can pay via bank transfer even for vendors who only accept check payments. Vendors receive either a check or bank transfer and Melio sends the check on your behalf.

- Automatic payments. You can avoid late payments using Melio’s payment scheduling features.

- Access anywhere, from any device. Since Melio is cloud-based, you can use it on the go from any digital device like a laptop, tablet, or smartphone.

Cons

- Currently for US-based businesses only. At present, Melio is only available to small businesses in the US.

- Limited customization features. Melio is a straightforward platform, so it may not be suitable for companies looking for customizations such as adding their business logos.

Detailed Melio Review

10. Refrens

Refrens is all-in-one business operating software with robust tools to streamline all your financial tasks. The app creates professional invoices, tracks payments seamlessly, and manages expenses efficiently – all within a user-friendly interface.

Along with its powerful billing software, it offers tools like Lead Management Software, Inventory and Expense Management Software, Sales CRM, and many more that help in day-to-day business operations.

Pros

- Automated Invoicing: Craft customized invoices that reflect your brand and impress your clients. Set up automated workflows to save even more time.

- Effortless Sharing: Share invoices with a single click directly through WhatsApp, email, secure link, PDF, or even physical print.

- Complete Customization: Design invoices with your unique flair using customizable templates, colors, fonts, and layouts. Add your logo and headers for consistent branding.

- Recurring Invoices on Autopilot: Automate billing for regular services, ensuring on-time payments and freeing up your time.

- Seamless Workflow: Convert quotations into professional invoices with a single click, streamlining your workflow.

- Effortless E-invoicing: Generate e-invoices with one click and stay on top of all legal compliance.

- Never Miss a Payment: Improve cash flow with automated reminders via WhatsApp and email.

- Secure Cloud Storage: Enjoy peace of mind knowing your financial data is safely backed up in the cloud for easy and secure access.

- GST Compliance Made Easy: Generate and manage GSTR-1 reports with a single click, simplifying GST filing in India.

Cons

- The free plan has limited tools

- Advanced features come with paid plans.

Billing Software: What’s on the Horizon?

Billing software has come a long way since it first replaced spreadsheets. This trend is expected to continue with the development of new technologies and increased user demand for more functionalities. The following are trends that are seen to impact billing software in the coming years.

Cloud To Rule Billing Software Market

Cloud-deployed systems will continue to dominate the billing software market, with more and more companies choosing applications that can easily be moved to the cloud.

Increased Billing Complexity

Newly-drafted regulations such as those in Europe are seen to drive ease-of-use and simplicity in billing systems. They have also resulted in more companies searching for niche markets in sectors like the automotive and medical industries.

Consumer Demand for Improved Payment Channels

With Millenial spending skyrocketing to more than $500 billion, businesses are left with no choice but to give in to demands from the age group, which include a wider selection of switching costs and more customized payment methods.

Increased Revenues From Cloud Billing

Global telecom cloud billing is seen to increase to around $22.84 billion in 2025 at a CAGR of 27.9%. This is seen to be driven by increased demand for cloud billing solutions that can employ complicated billing schemes.

How does billing software support subscription management?

Billing software is increasingly being used to manage subscriptions, offering businesses tools to handle recurring billing processes seamlessly. Here are some ways that modern billing software supports subscription management:

- Automated Recurring Billing: Many billing software solutions allow businesses to set up automated recurring billing for subscriptions. This ensures that invoices are sent out at the right intervals and payments are collected automatically, reducing the need for manual intervention.

- Flexible Subscription Plans: Billing software often supports various subscription models, such as monthly, quarterly, or annual plans. This flexibility allows businesses to offer different pricing tiers or payment schedules to suit customer preferences.

- Proration for Plan Changes: When customers upgrade, downgrade, or cancel their subscription mid-cycle, proration ensures they are charged or refunded correctly for the time used. Billing software can automatically calculate these adjustments.

- Trial Management: Some systems include features for managing free trials or introductory offers, allowing businesses to automatically convert trial users into paying customers once the trial period ends.

- Subscription Analytics and Reporting: Advanced billing software provides real-time insights into subscription metrics such as monthly recurring revenue (MRR), customer lifetime value (CLV), churn rate, and customer retention. This helps businesses understand their subscription performance and make data-driven decisions.

- Dunning Management: To reduce involuntary churn due to failed payments, billing software can automate dunning processes, which involve sending reminders or retrying payment methods for failed transactions.

- Self-Service Customer Portals: Many billing platforms offer customer portals where users can manage their subscriptions, update payment details, or change plans without contacting support. This enhances the customer experience and reduces administrative workload.

What is the Best Billing Software for Your Business?

And that’s about it, the 10 best billing software systems as determined by our experts. You may be itching to get your hands on one and rightly so. But, remember there are considerations to be made if you are to find the right solution for your company. In fact, what works best for you will depend on a raft of factors such as your needs and budget. Do you want standalone billing software? What’s the size of your business? How much do you want to spend?

Put all your needs on the scale and weigh them against the available software options. Make sure you get an app that fits your scenario. For instance, choosing among these top invoicing apps for Mac if device deployment is a factor for you. Moreover, take advantage of free trials to evaluate a platform before purchasing a subscription, like with our top choice here, NetSuite ERP.

How does billing software support subscription management?

Billing software is increasingly being used to manage subscriptions, offering businesses tools to handle recurring billing processes seamlessly. Here are some ways that modern billing software supports subscription management:

- Automated Recurring Billing: Many billing software solutions allow businesses to set up automated recurring billing for subscriptions. This ensures that invoices are sent out at the right intervals and payments are collected automatically, reducing the need for manual intervention.

- Flexible Subscription Plans: Billing software often supports various subscription models, such as monthly, quarterly, or annual plans. This flexibility allows businesses to offer different pricing tiers or payment schedules to suit customer preferences.

- Proration for Plan Changes: When customers upgrade, downgrade, or cancel their subscription mid-cycle, proration ensures they are charged or refunded correctly for the time used. Billing software can automatically calculate these adjustments.

- Trial Management: Some systems include features for managing free trials or introductory offers, allowing businesses to automatically convert trial users into paying customers once the trial period ends.

- Subscription Analytics and Reporting: Advanced billing software provides real-time insights into subscription metrics such as monthly recurring revenue (MRR), customer lifetime value (CLV), churn rate, and customer retention. This helps businesses understand their subscription performance and make data-driven decisions.

- Dunning Management: To reduce involuntary churn due to failed payments, billing software can automate dunning processes, which involve sending reminders or retrying payment methods for failed transactions.

- Self-Service Customer Portals: Many billing platforms offer customer portals where users can manage their subscriptions, update payment details, or change plans without contacting support. This enhances the customer experience and reduces administrative workload.

Key Insights

- Automating Invoicing Processes: Billing and invoicing software automate invoicing processes, reducing the time it takes to process invoices and minimizing manual errors.

- Mobile Accessibility: Many billing software solutions offer mobile capabilities, allowing users to manage invoicing and billing from any location and on any device, which is especially crucial in the current work-from-home environment.

- Multiple Billing Models: Advanced billing software supports various billing models, including subscription, one-time, project-based, and hybrid models, providing flexibility for different business needs.

- Integration with Accounting Systems: Many billing software solutions integrate seamlessly with popular accounting and ERP systems, enhancing overall financial management and reducing manual data entry.

- Real-time Reporting: These platforms often include robust reporting features, offering real-time insights into financial data, helping businesses make informed decisions.

- Customizable Invoices: Most billing software provides customizable invoice templates, allowing businesses to maintain consistent branding and professionalism in their invoicing.

- Payment Gateways: Integrated payment gateways enable businesses to accept payments through various methods such as credit cards, ACH, and PayPal, facilitating faster and more convenient transactions.

- Cost Management: Automated billing and invoicing help businesses manage costs by reducing the time and resources spent on manual invoicing, allowing employees to focus on more critical tasks.

FAQ

- What are the benefits of using billing and invoicing software? Billing and invoicing software streamline the invoicing process, reduce manual errors, offer real-time reporting, and support multiple billing models. They also integrate with accounting systems, provide mobile access, and enhance payment processing capabilities.

- How does billing software improve efficiency? By automating invoicing processes, billing software reduces the time and effort required to create, send, and track invoices. This allows employees to focus on more critical tasks, improving overall efficiency.

- Can billing software integrate with my existing accounting system? Yes, many billing software solutions integrate seamlessly with popular accounting and ERP systems, ensuring a smooth flow of financial data and reducing the need for manual data entry.

- What types of payment methods can billing software handle? Billing software typically supports various payment methods, including credit cards, ACH transfers, PayPal, and sometimes international wire transfers, making it easier for businesses to receive payments from clients.

- Is billing software suitable for small businesses? Yes, there are many billing software solutions designed specifically for small businesses, offering features like customizable invoice templates, expense tracking, and integration with payment gateways, often at a lower cost.

- How does billing software help with compliance? Billing software helps businesses stay compliant with tax laws and regulations by automating tax calculations and ensuring that invoices include all necessary information. Some software also updates automatically to reflect changes in legislation.

- Can I access billing software on mobile devices? Many billing software solutions offer mobile capabilities, allowing users to manage invoicing and billing tasks from smartphones and tablets, providing flexibility and convenience, especially for remote work.

- What should I consider when choosing billing software? When choosing billing software, consider factors such as your business size, budget, specific invoicing needs, integration requirements with existing systems, and whether you need mobile access. Evaluating free trials can also help you determine the best fit for your business.

- Are there free billing software options available? Yes, some billing software solutions offer free plans with basic features suitable for small businesses or freelancers. However, advanced features and higher usage levels typically require a paid subscription.

- How can billing software help reduce late payments? Billing software can automate payment reminders, set up recurring billing for subscription services, and provide clients with multiple payment options, making it easier for them to pay on time and reducing the incidence of late payments.

Leave a comment!