Are you looking for an alternative to Expensify? Expensify can help you track and manage your expenses. But it is not without issues such as limited credit card linking, few reporting options, lack of reminder feature, and unintuitive integration with accounting solutions.

You may want to look beyond Expensify. But you may ask – with so many similar expense management apps in the market, where do you even start your search?

To help you out, our review experts have evaluated the leading expense management software and come up with this top 10 alternatives to Expensify guide. You’ll learn each software’s features and benefits and why they’re on the list and ranked as such, and evaluate them against Expensify’s capability to manage money matters, transactions, and expenses through its real-time reporting and data processes.

Top 10 Alternatives to Expensify

In a list prepared by allbusiness.com, the first four among the top 10 reasons for small business failure involves finances. There’s the over-eagerness to grow fast that startups over-spend, add more overhead, fail to track expenses and underestimate the capital required. Finances are stretched thin to the breaking point due to poor financial planning and management.

While SMBs are more vulnerable to finance-related factors that lead to failure, many big businesses have also collapsed because of their owners’ lack of understanding of the financial and administrative aspects of their business. Add to these the inability to innovate, undertake effective marketing, and poor leadership, among others, and you will see even established companies bite the dust.

Expense management is one of the most crucial areas companies struggle with when handling their financials. Below are the major challenges that organizations encountered:

Source: PayStream Advisors

The aforementioned issues revealed by the survey findings can be addressed by robust expense management platforms. Businesses are coming to grips with the capability of this type of financial solution, with Technavio predicting an extensive deployment of expense management software in all industries by 2021. The use of reliable and accurate expense analytics is expected to transform expense management from operational activity to an important process that allows for continuous improvement.

Moreover, having expense automation built into this type of software will minimize expense fraud, preventing such by offering a strong infrastructure. It is with their solid capabilities and modern features that enterprises are also shifting from old-fashioned systems provided by legacy vendors to modern and more suitable expense management tools. Some have even opted for an integrated enterprise resource planning system or full-featured financial accounting software with expense management tools such as those we’ve included in this list of top 10 alternatives to Expensify. Most of these products are online expense tracking solutions that bring several benefits including process automation and policy enforcement.

Let’s begin the business of choosing the appropriate expense management app by giving you an overview of Expensify.

What is Expensify?

Expensify is a business platform that offers a user-friendly interface and accounting functions which can be utilized for money management matters. It enables companies to maintain summaries of various accounts and calendars to obtain transparency. In addition, a number of ratios like debt-to-income ratios can be balanced at the appropriate time to prevent crises.

Expensify also provides robust tools to monitor your travel costs based on the distance traveled or the time utilized on a specific project. For international travel, you can convert currencies and store the data in appropriate text fields. In addition, the software presents a simple module to record expenses by the info provided through images (purchase receipts).

Benefits of Expensify

- The software makes it quick and easy for companies to manage the costs incurred through years or months.

- You can sync all your account data with your mobile to save transactions in both places.

- It automates the workflow of expense reporting and tracking from the initial stage to the finalization of expense reports.

- It permits automatic integration of the platform with credit cards, financial institutions, or other payment methods to eliminate the need for manual data entry.

- You can utilize this solution while making deposits or purchases which enables you to record info in real time.

- It permits tracking costs incurred on business trips via GPS technology, which automatically tracks the distance traveled and records them for reimbursements or deductions.

However, Expensify, just like any other tool couldn’t possibly offer you every feature you need in an expense management solution. If you wish to look for other solutions, check the essential details about the main features and benefits of the top 10 alternatives to Expensify. We give you three good reasons to consider the alternative app instead of Expensify and vice versa.

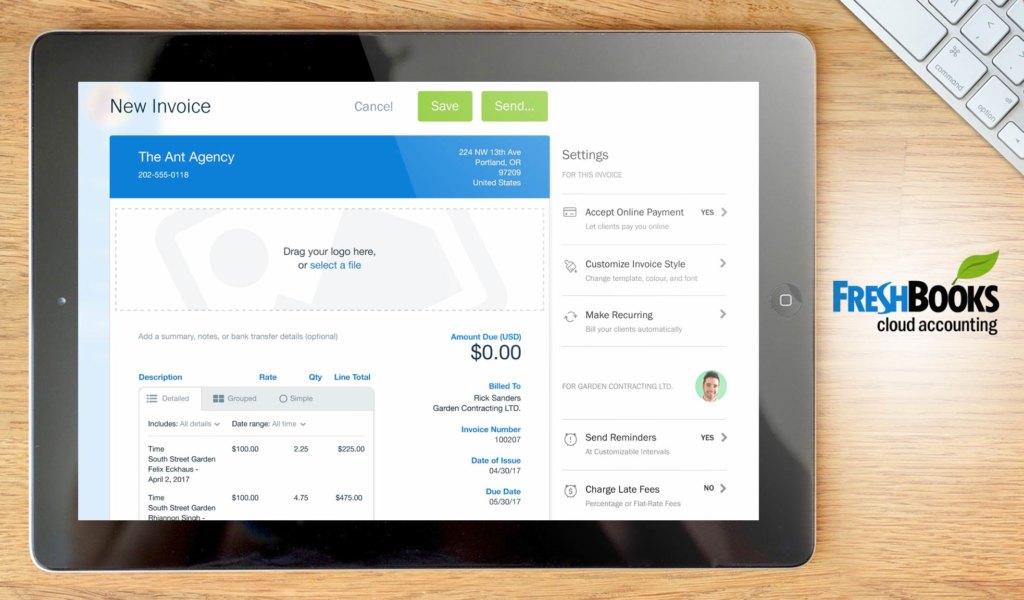

1. FreshBooks

FreshBooks is utilized by more than five million companies to streamline client invoicing and time tracking. Freelancers also use it to fast track their sales cycle and collection and provide a professional look by custom-branding their financial files with company colors and logos. The app is successful because it offers great features and a flexible pricing scheme that enables small and medium-sized companies in all sectors to take advantage of the benefits that it offers.

FreshBooks is a fast and reliable accounting suite that makes the complex matter of financial management into a fun experience. With this software, enterprises can manage recurring subscriptions and invoices quickly and easily, and collect online payments within the system. In addition, The tool enables credit card, PayPal, and Google Checkout payments, and integrates with a number of business solutions that can streamline this process. In short, the platform lets you unite financial control in a single program and save the costs of maintaining complex software infrastructure.

The app is constantly finding itself sporting new features and functionalities, which are intended to further help users. An example of this is the fact that the software now supports collaboration while getting a newly-designed dashboard. It can also generate more invoices, which as always are customizable and can be tracked from the same interface. Task prioritization is now possible with its time tracking feature, resulting in accounting that is more transparent. The vendor likewise improved FreshBooks’ search feature while adding support for different currencies.

If you wish to scout for other solutions, browse FreshBooks alternatives here.

Why use FreshBooks instead of Expensify?

- It allows you to take detailed time entry notes.

- It enables you to track offline payments.

- It supports multi-currency and multi-language.

Why use Expensify instead of FreshBooks?

- It facilitates flexible travel integrations.

- It presents corporate cards.

- It generates real-time expense reports.

Detailed FreshBooks Review

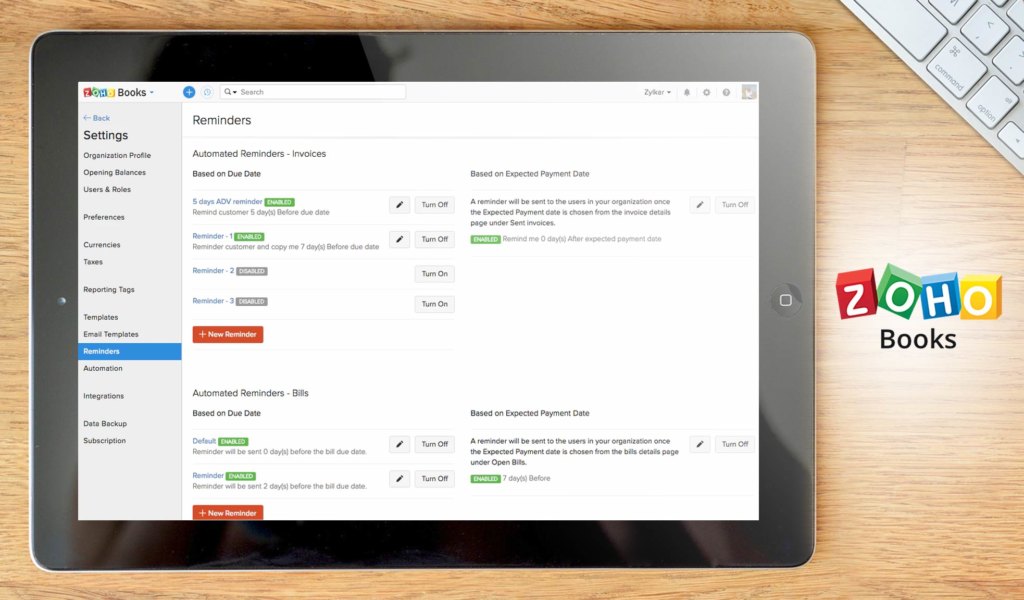

2. Zoho Books

Zoho Books allows you to send professional invoices to your clients and receive online payments from them in a single solution. The app is convenient, robust, and fast, and helps businesses to control their finances and save more. This is facilitated by features such as balance sheets, P&L, cash flow statements, and more. The pricing packages are affordable and budget-friendly for small businesses and mid-market companies.

Aside from the above, you can now enjoy additional features as the vendor makes sure that Zoho Books receives constant improvements. It is now able to include multiple timesheets and projects in a singular invoice, This is particularly useful if you’re working for a single customer with multiple projects. Customers automatically receive notifications via text messages whenever invoices are created, paid or to simply remind them of pending payments.

You can even open external sites directly from the platform through its custom link feature. This will benefit users who need to search for outside sources. Credit limits can also be set for specific customers, barring those who exceed their limits from creating invoices.

For more good options, peruse these Zoho Books alternatives.

Why use Zoho Books instead of Expensify?

- It presents a collaborative client portal.

- It offers invoice templates.

- It provides inventory management tools.

Why use Expensify instead of Zoho Books?

- It deploys PCI-compliant security.

- It facilitates candidate reimbursement and direct deposit reimbursement.

- It offers advanced approval hierarchies.

Detailed Zoho Books Review

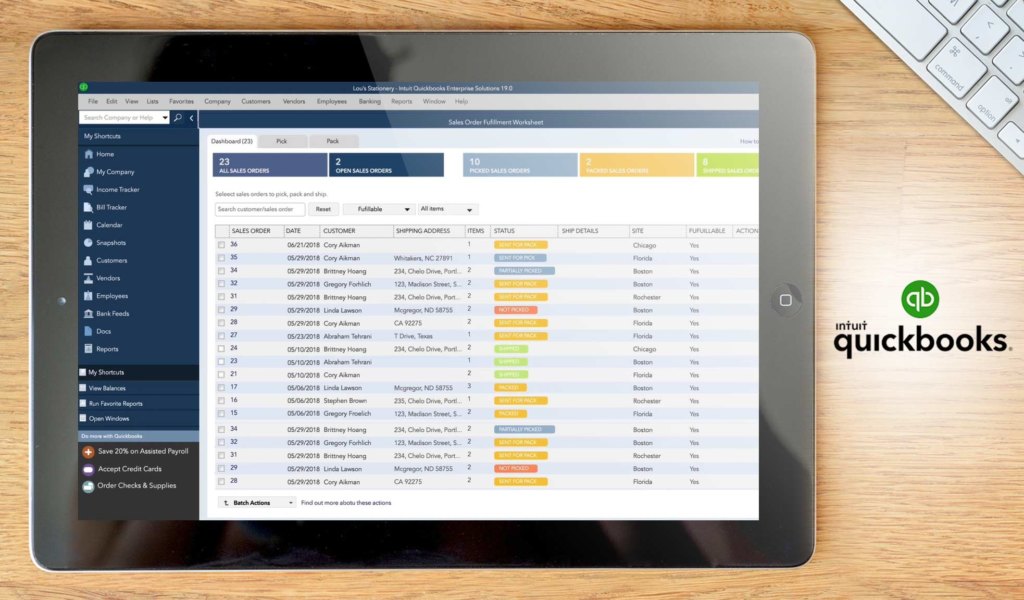

3. QuickBooks Enterprise

QuickBooks Enterprise uses a supercharged QuickBooks accounting software but focused on addressing the requirements of specific industries and sectors such as manufacturing and wholesale, retail, contracting, professional services, and non-profit. The Enterprise edition offers six times the capacity of other QuickBooks products and supports up to a million list of items, vendors, and users. It has advanced customizable reporting and delivers powerful functionality to manage payroll, taxes, payments, and inventory. The best thing is it’s tailored for your industry, providing specialized features like reports targeted for your business and customized chart of accounts.

QuickBooks Enterprise gives you one-click financial, tax, and sales reports as well as a consolidated view across your business. It lets you track international sales and expenses in multiple currencies, forecast sales and expenses, track and manage inventory, monitor sales taxes, and customer payments. You can use the core QuickBooks features you’re accustomed to including expense management functionalities to help you better manage business spending.

Likewise, expenses can be tracked and recorded into the system, categorized, and added to your books. Accounting and financial information are automatically synced across all your devices to ensure that your records are constantly updated. Your tax deductions are also accurately managed, with the software efficiently tracking your expenses and creating tax categories that are tailored to your business.

Detailed QuickBooks Enterprise Review

If you’re still unconvinced, you can also look for these Quickbooks Enterprise alternatives.

Why use QuickBooks Enterprise instead of Expensify?

- Input expense transactions fast from multiple banks and accounts in one place.

- It lets you track expenses and pay bills automatically.

- It is built for industry-specific enterprise businesses.

Why use Expensify instead of QuickBooks Enterprise?

- It implements PCI-compliant security.

- It provides flexible travel integrations.

- It has tools for monitoring travel costs.

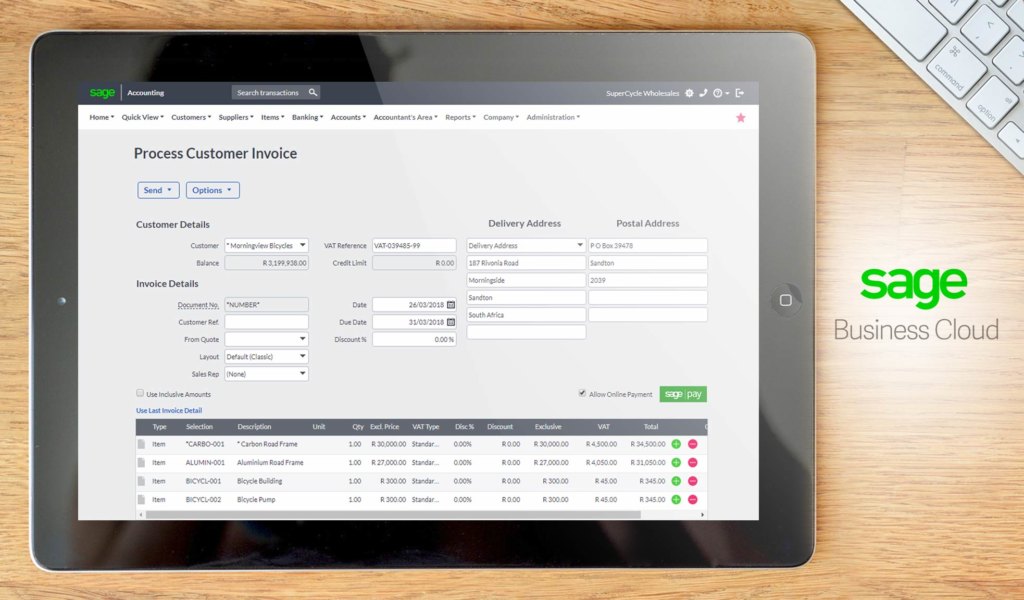

4. Sage Business Cloud Accounting

Sage Business Cloud Accounting is an easy-to-use accounting solution. It integrates with its sister platform Sage 50cloud to offer cloud storage and accessibility to your accounting info. The program’s graphs, dashboards, and drill-downs to transactions offer a detailed overview of your company any time via the Internet. Key features include customer sales history, supplier purchases, and bank statement imports that enable you to manage your cash flow and banking.

Sage Business Cloud Accounting is an excellent expense management tool. It harnesses the power of the cloud, offering users easy access and secure information storage in the process. You also get a detailed overview of your organization as the solution makes use of data visualizations to reflect your transactions. It likewise makes a record of your transactions with suppliers while enabling you to effectively handle your cash flow and banking by importing bank statements. Billable expenses and time can be entered into invoices manually allowing you to keep a record of them as well. It accelerates reconciliation of your books with your bank accounts by keeping a record of previously used categories. Bank statements can likewise be uploaded to the system. It is mobile-optimized, supporting both Android and iOS devices.

If you’re not impressed, take a look at Sage Business Cloud Accounting alternatives here.

Why use Sage Business Cloud Accounting instead of Expensify?

- It provides a range of reporting options.

- It offers a report designer you can use to design your own layouts and formats.

- It allows bank statement imports.

Why use Expensify instead of Sage Business Cloud Accounting?

- It provides GL code mapping.

- It offers a multi-stage approval workflow.

- It facilitates multi-level tagging.

Detailed Sage Business Cloud Accounting Review

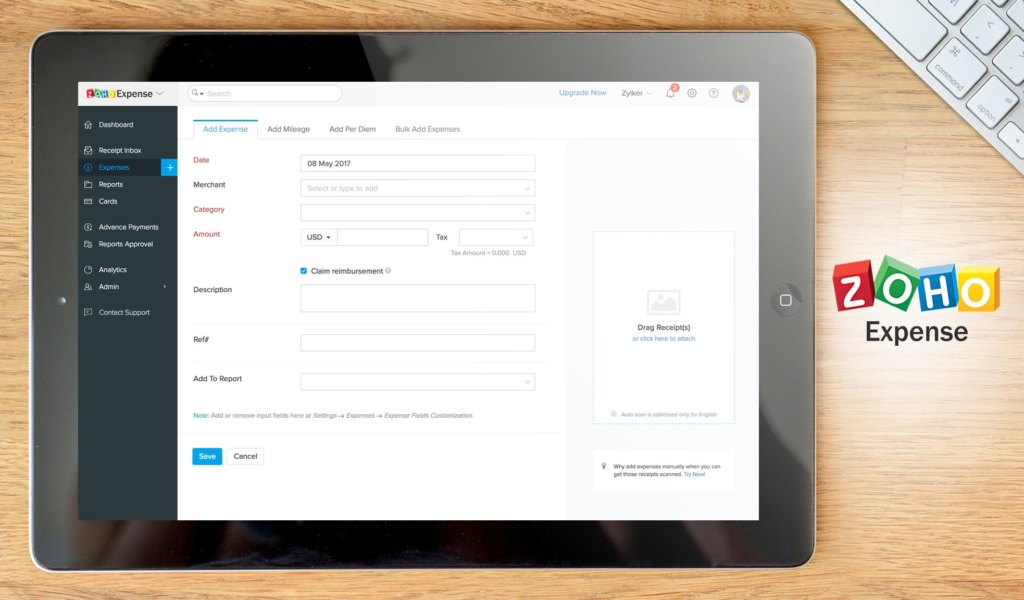

5. Zoho Expense

Zoho Expense is a popular expense management software owing to its ability to make expense tracking and reporting more fun and easier for businesses. Using the system, many expense management processes are automated, making transaction recording faster. You can generate reports using receipts that have been converted into expenses with the click of a mouse. This is most useful in determining your company’s financial performance. For credit card transactions, Zoho Expense automatically collects and converts them into expenses.

The platform ensures that your company’s spending policy is observed by getting rid of messy issues concerning allowed expenses and limits on spending. It comes with a user-friendly interface that enables you to send recipients via email and simply drag-and-drop receipts onto the main screen. Zoho Expense seamlessly integrates with Zoho CRM and Zoho Books, giving you all the functionalities of all three platforms for the same pricing plan. The system is mobile optimized so that you can access your accounting information anywhere at any given time using a smartphone.

For more good options, try out these Zoho Expense alternatives here.

Why use Zoho Expense instead of Expensify?

- It automates expense recording.

- It allows multi-currency expensing.

- It offers expense analytics.

Why use Expensify instead of Zoho Expense?

- It provides real-time expense reports.

- It facilitates direct deposit and candidate reimbursement.

- It enables advanced tax tracking.

Detailed Zoho Expense Review

6. FreeAgent

FreeAgent is a robust online accounting software that is designed to meet the needs of freelancers and small businesses. This feature-rich solution offers enterprises the tools they require to keep their finances on track. They can utilize these capabilities to manage all elements of their financial operations – from payroll running to handling expenses.

With FreeAgent, you can send and track invoices created by the software. Plus, you can easily monitor expenses by taking a picture of your receipt on your phone and uploading it to the program. Another highlight is the inbuilt stopwatch and timesheets that you can utilize to keep time records.

In addition, the platform can be linked to bank accounts to allow automatic import of transactions into the system. Finally, the application supports 26 third-party app integrations including Receipt Bank, Stripe, PayPal, and Zapier which can connect the solution to more than 750 add-ons.

If you’re not satisfied, have a look at other FreeAgent alternatives.

Why use FreeAgent instead of Expensify?

- It provides multi-language support.

- It allows you to customize invoices.

- It offers attractive invoice templates.

Why use Expensify instead of FreeAgent?

- It permits you to set up expense rules.

- It allows credit card imports.

- It offers duplicate expense detection.

Detailed FreeAgent Review

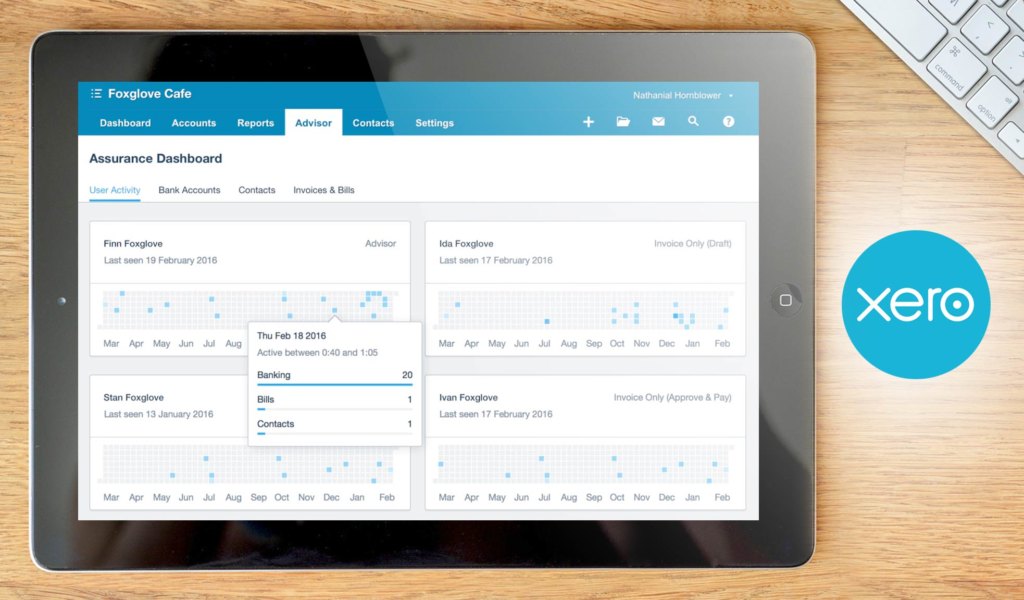

7. Xero

Xero is a popular accounting platform that is known for catering to SMBs, offering them all the tools that they need to handle their accounting processes. The system is quite easy to set up, requiring but little time and no training at all. Every transaction and contact can be accessed from a single console while allowing you to edit entries even in the field. It offers numerous features as tools that come with the software and not costly add-ons.

But what’s notable about the software is its Xero Expenses tool, which allows you to effectively manage your expenses while providing access to analytics. All it takes is a photo of a receipt and the system automatically creates an expense claim. Expenditure patterns can be identified through reports generated by the app. It can be integrated into your accounting process and can automatically pay bills and create journal entries. This tool is bound to cut costs, give you actionable insights and enable you to give your clients impeccable support. Expense claims can be captured and recorded even from your mobile device as Xero supports both Android and iOS platforms.

However, if you think that the tool is too basic for you, there are more Xero alternatives here.

Why use Xero instead of Expensify?

- It offers access to analytics.

- It can identify spending patterns.

- It can capture and record expense claims.

Why use Expensify instead of Xero?

- It provides GL code mapping.

- It facilitates multi-level tagging.

- It offers a multi-stage approval workflow.

Detailed Xero Review

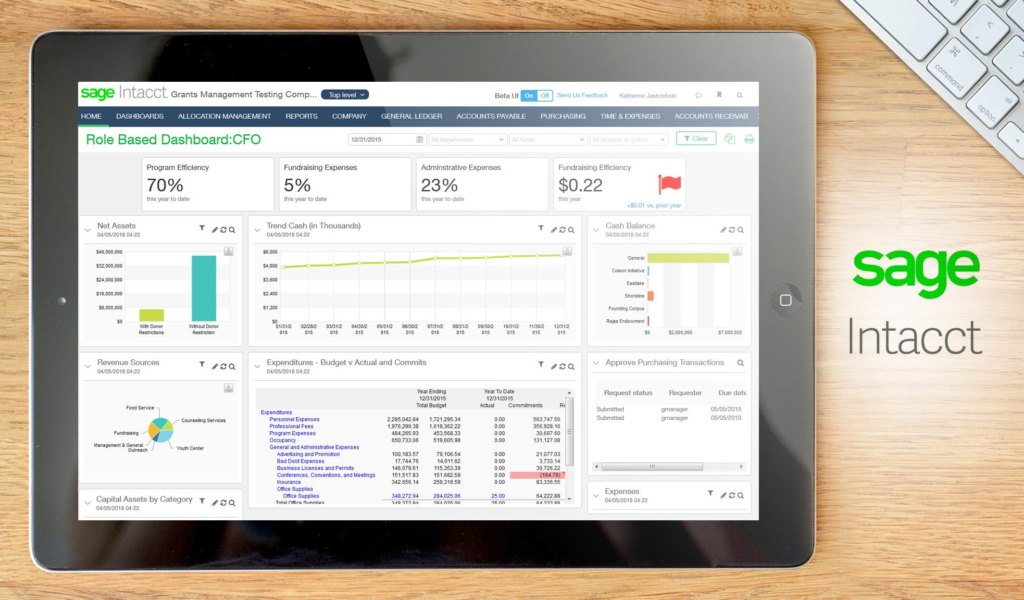

8. Sage Intacct

Cloud-based financial management tool Sage Intacct is a robust platform that combines the capabilities of Sage and Intacct, harnessing the power of the cloud to provide users with a very enjoyable accounting experience. It is targeted at growing companies, helping them boost efficiency and expand their horizons. The system automates every accounting process there is, allowing users to focus on more important areas of their operations. It is a full-featured tool, bringing to the table functionalities such as accounts receivables and payables, expense management, and cash management.

As an expense management solution, Sage Intacct offers numerous benefits. It makes expense and time management easier by allowing staff to enter their own expense and time information. These reports can be accessed by managers for approval in real time as they are automatically alerted by the system. Its dashboard likewise offers visibility into project progress and profitability while monitoring time for billable hours. Information on time and expenses are automatically uploaded to the system’s revenue and invoicing recognition tool, saving users a lot of time. The software truly speeds up expense management, resulting in improved decision-making.

Detailed Sage Intacct Review

However, if you feel that the tool just isn’t the one for you, there are other Sage Intacct alternatives to choose from.

Why use Sage Intacct instead of Expensify?

- It allows staff to enter their own expense/time data.

- It alerts managers to employee expense/time reports.

- It offers a view of project progress and profitability.

Why use Expensify instead of Sage Intacct?

- It provides real-time expense reports.

- It facilitates direct deposit reimbursement and candidate reimbursement.

- It enables advanced tax tracking.

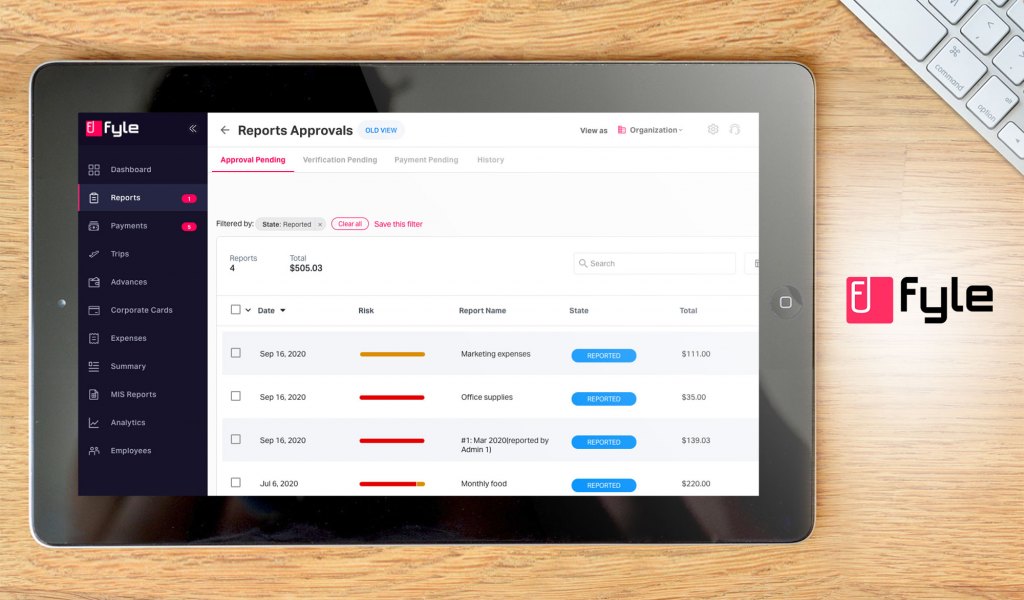

9. Fyle

Fyle is billed as a new-age AI-powered credit card expense management solution. It connects with all existing credit cards, including Visa and Mastercard, and tracks spending in real time. Notifications are sent instantly after a registered card is swiped. You can get them on the app, via text, and email. This makes expense tracking and reporting easy, saving businesses valuable time and resources usually spent on doing reports.

The software comes with an OCR capability that automatically extracts data from digital and printed receipts. Its powerful AI can categorize receipts by merchants, making approvals faster. Its mobile app allows employees to submit expenses on the go. This is especially helpful with cash purchases with printed receipts and dealing with reimbursements. Speaking of reimbursements, you can send them via ACH right in the app itself. It also includes a dashboard that allows you and your employees to track payment statuses.

The platform has tools for managing mileage claims, trip authorization and requests, and approval workflows. It provides a good degree of flexibility in terms of customizing your approval hierarchy. Furthermore, like other top apps, Fyle has an automatic accounts reconciliation feature on board. The software service is packed with analytics tools, including one for generating budget insights. Moreover, Fyle integrates seamlessly with popular accounting solutions. This allows you to sync your expense management data with that of your overall finances. Accounting integrations include those for Xero and QuickBooks. Lastly, pricing starts at $6.99 per user per month.

If this is not the app for you, you can check out other Fyle alternatives that might fit your particular needs and preferences.

Why use Fyle instead of Expensify?

- It has an easy-to-use reimbursement management feature.

- It has smooth cross-platform performance.

- It offers intuitive approval workflow customization controls.

Why use Expensify instead of Fyle?

- It is priced a little lower.

- It has more integrations.

- It has advanced tax tracking features.

10. FinancialForce Accounting

FinancialForce is primarily an accounting platform but has expense management features that could help organizations better handle their spendings. It is targeted at both SMBs and large enterprises who seek to gain streamlined workflows and reduce costs. The tool is a total solution that can handle just about any financial transaction. It is highly-intuitive that you can learn its expense management functionalities quite quickly. These include billing, time reporting, advanced reporting, project financials, and resource management.

More importantly, FinancialForce enables you to avoid errors in expenses entry while offering currency conversions that are accurate, helping you save on costs. Making decisions about both long- and short-term budgeting and expenditure policy adjustments are also made possible with the software.

For employees, the platform’s ability to generate tracking and expense reports will speed up expense approvals, resulting in improved employee satisfaction. They can also easily file expenses through the cloud, using a single platform.

Detailed FinancialForce Accounting Review

In case you are not satisfied with the tool’s features, you can find more from our FinancialForce alternatives.

Why use FinancialForce instead of Expensify?

- It helps prevent errors in expense data entry.

- It offers accurate currency conversions.

- It helps make budgeting and expenditure adjustments.

Why use Expensify instead of FinancialForce?

- It enables automatic accounting sync.

- It facilitates automatic approval and reimbursement.

- It offers advanced tax tracking.

What’s Next For Expense Management Systems?

Expense management software has indeed come a long way, bringing with it functionalities that make tedious tasks easier. In fact, many believe that expense management has yet to get a boost from promising technologies, which could essentially be a game changer for the majority of businesses around the world. Here are some of them:

- Cloud computing. Cloud-based expense management systems have gained a significant slice of the app market. Vendors have been automating conventional workflows, including all aspects of expense reimbursement. These platforms have managed to evolve into a single solution for all expense management processes.

- AI + Big Data. Expense management is seen to benefit from the use of emerging technologies in the coming years. These include big data, artificial intelligence and machine learning, tools that can cater to changes in user requirements. AI applications in expense management can come in the form of data entry based on user patterns.

- Virtual Assistants. With the way things are going, the development of virtual expense management assistants may not be a pipeline dream after all. These will be fully-integrated solutions capable of identifying business transactions and flagging them as expenses. Expense approval is also seen to become faster, along with the merging of expense data with organizations’ financial information.

Make an Informed Decision When Buying Software

Bear in mind that all the systems we’ve presented have their own strengths and weaknesses. It is our goal to give you all relevant details about the software and the closest solid alternatives so you can make information-based decisions. Buying a software solution is an investment after all and you would want to make the right choice from the very start. So carefully go through the options and alternatives. Based on our reviews and ratings, we suggest you try our top pick for expense management software. Just sign up for Freshbooks free trial.

If you need additional information about these platforms and would want initially to go for a zero-cost solution, we have prepared our best free accounting software guide that you can check out. Ultimately, the decision is yours to make. Hence, make it count and make it right with the tips and choices we’ve laid out for you.

Leave a comment!